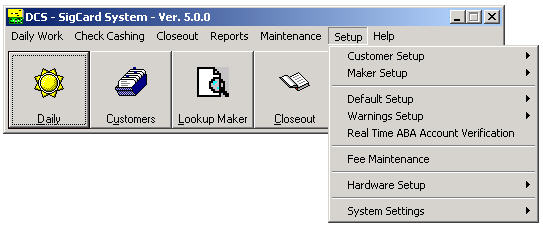

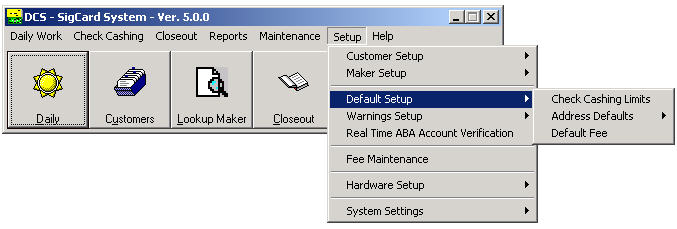

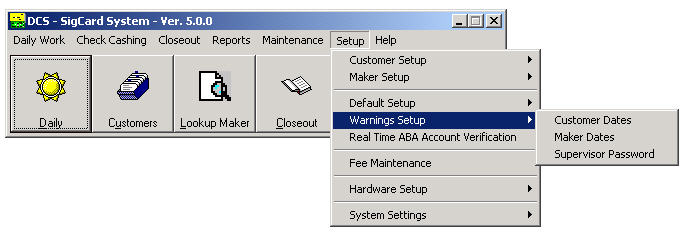

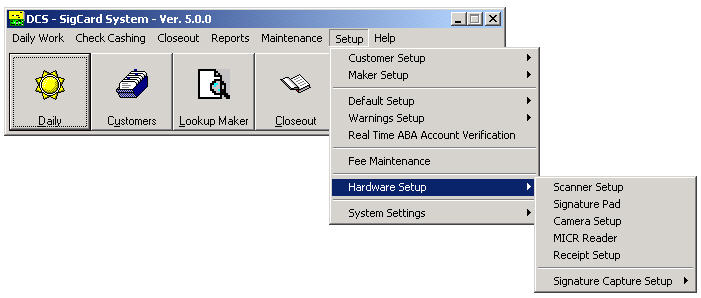

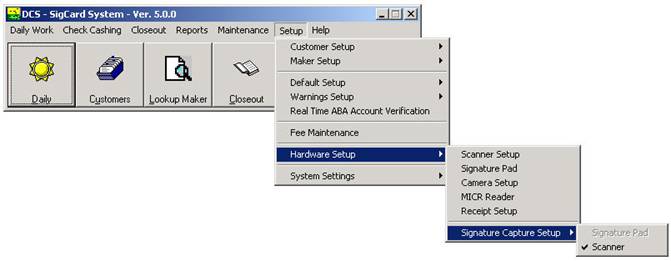

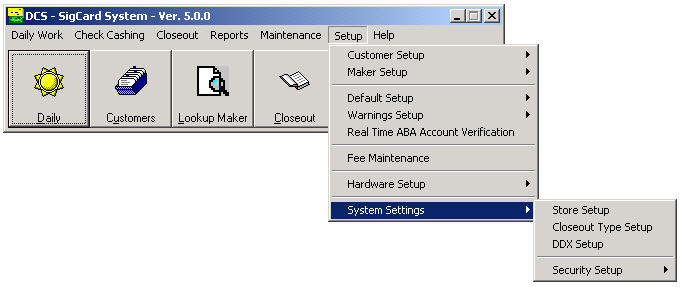

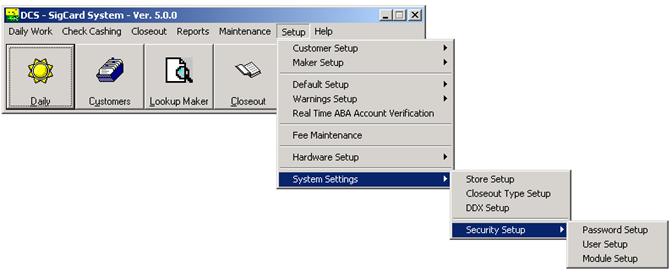

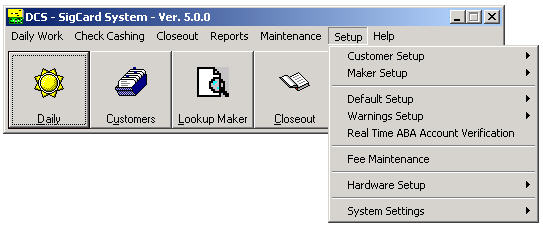

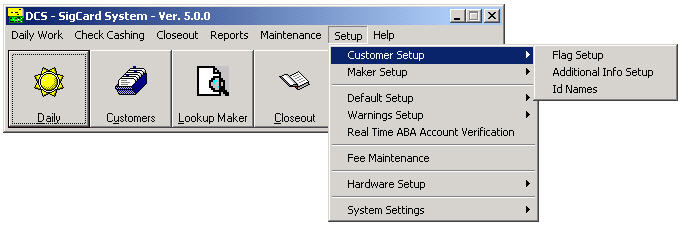

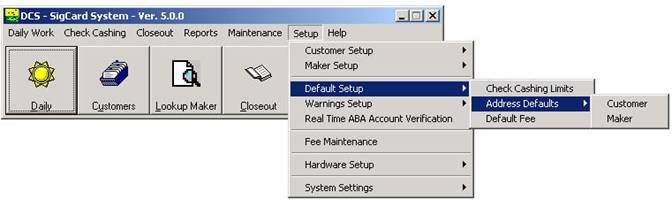

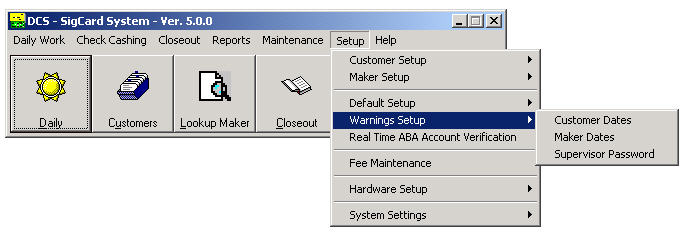

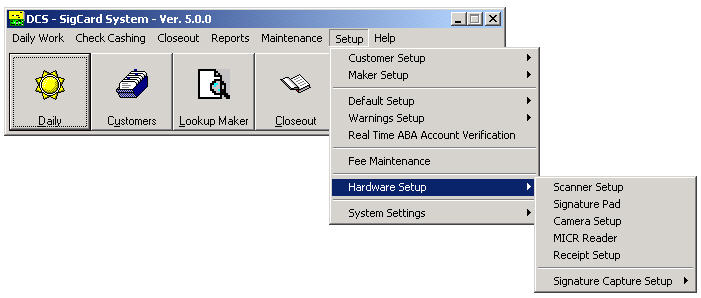

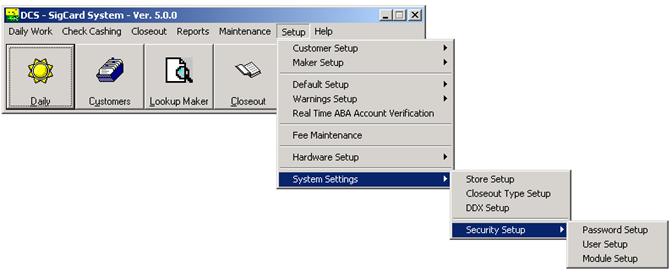

Before using SigCard, you need to make several

decisions on how it should operate. SigCard uses various defaults and tables

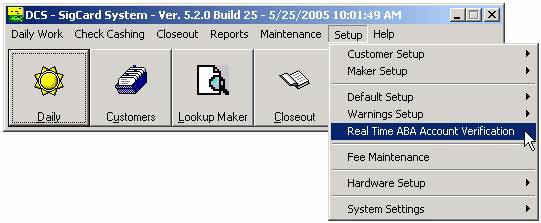

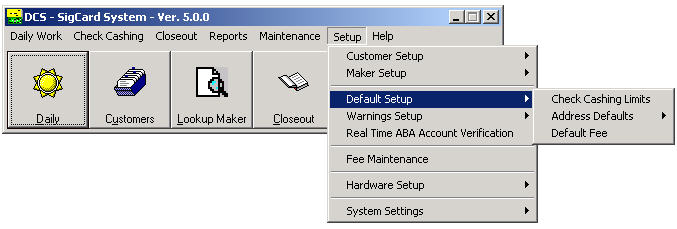

that are established via the Setup Menu. Select Setup from the main menu. The

Setup Menu consists of several options as displayed on the screen below.

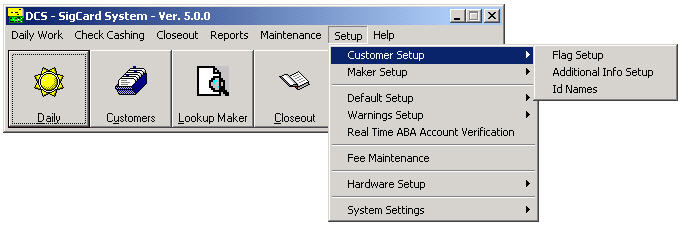

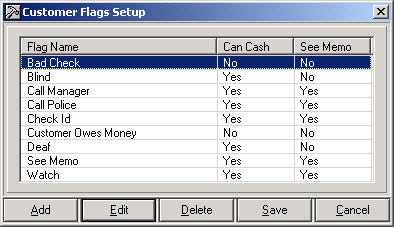

Customer Setup

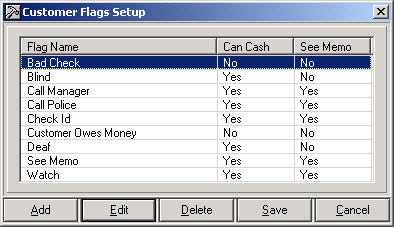

Flag Setup

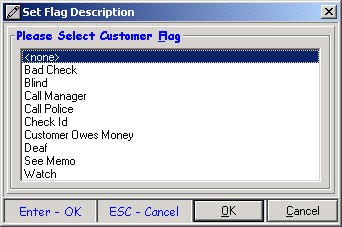

A flag is a notation that appears on the customer

information screen. You can set up an unlimited number of flags to be used to

immediately bring to your attention a condition you wish to be notified about

regarding a particular customer. Only one flag can been associated with a specific

customer. You can designate Can Cash and/or See Memo with the flag.

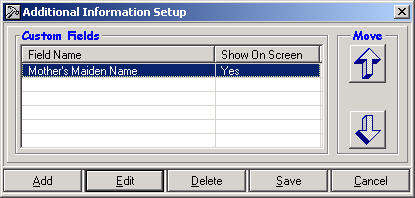

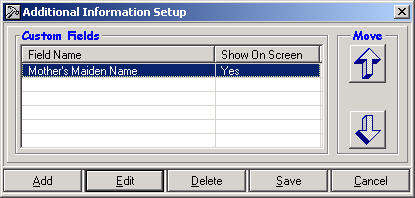

Additional Information Setup

User defined fields can be added for additional

customer information. There can be unlimited custom fields; two will be displayed

on the customer information screen as separate fields. All others will be

displayed in the Additional Information.

ID Names

SigCard allows you to setup your

own ID names and descriptions based on the types of identification you accept.

You can setup a driver's license, government ID, passport, or any other type of

acceptable ID. You can also specify the

type of character that is allowed in each position of the ID field by defining

an 'input mask'. The input mask is a template that helps eliminate input

errors. There are a number of characters that you can use to design the ID

mask. Some of these characters restrict the data that can be entered. Below is

a list of the format characters and their restrictions.

|

X

|

Alpha, numeric and special characters

|

a,b,c,d

1,2,3

#$%

|

|

9

|

Numbers only

|

1,2,3,4

|

|

A

|

Alphabetical only

|

a,b,c,

|

|

!

|

Upper case alphabetical only

|

A,B,C

|

An example of an Illinois

driver's license is: G265-3434-7588

The input mask would be:

A999-9999-9999

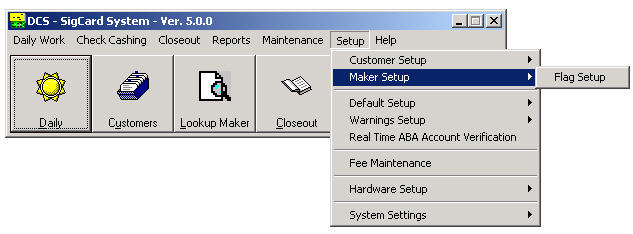

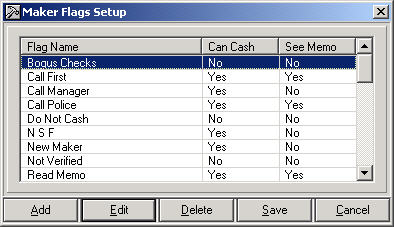

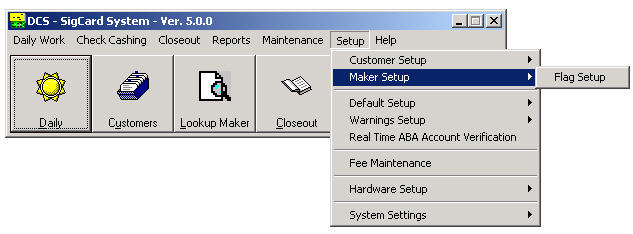

Maker Setup

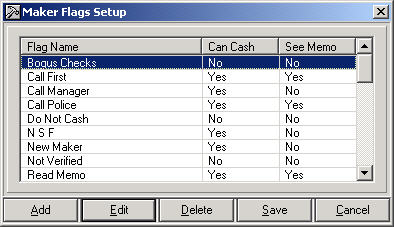

Flag

Setup

A flag is a notation that appears on the maker

information screen. You can set up an unlimited number of flags to be used to

immediately bring to your attention a condition you wish to be notified about

regarding a particular maker. Only one flag can been associated with a specific

maker. You can designate Can Cash and/or See Memo with the flag.

Default Setup

Default settings are restrictions and values that will

automatically be processed or entered as information. If the default is

informational, it can be changed by the user. As an example, if the customer

address is automatically entered as the state of Illinois,

the user can change it to another state.

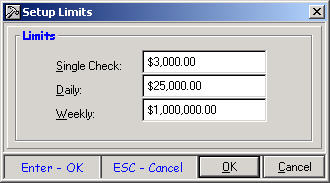

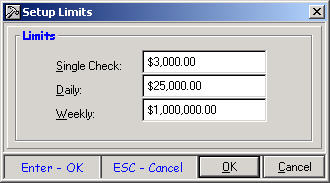

Check Cashing Limits

Limits can be set to warn a teller whenever they have

a check cashing transaction where the single check, daily, or weekly amount is

exceeded. The teller will not be prevented from completing the transaction.

Single. Allows

you to setup a warning based on how much you allow a teller to cash for any

single check.

Daily. Allows

you to set up a warning based on how much you allow a teller to cash in one

day.

Weekly. Allows

you to set up a warning based on how much you allow a teller to cash in a week.

A week is always the past seven calendar days and not Monday through

Sunday.

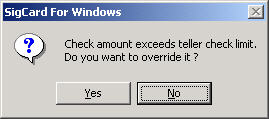

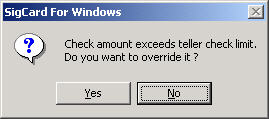

If the

limit is reached, the following warning will be displayed.

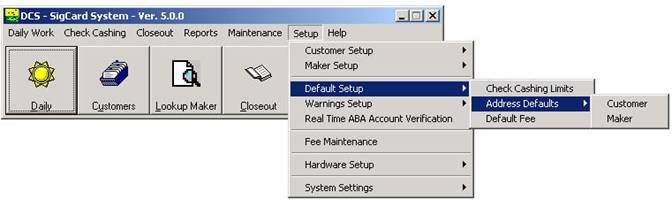

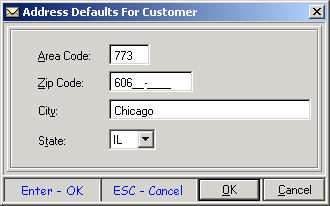

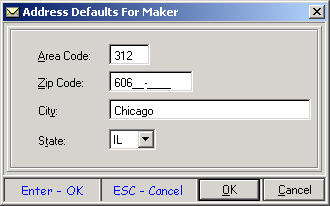

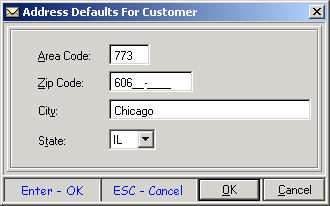

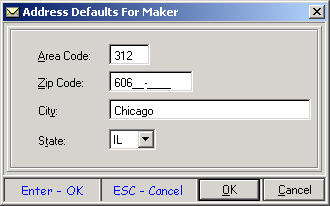

Address Defaults

For each customer and maker record that you add to

your files, you will need to input information into various fields. In order to

simplify input, SigCard lets you setup a number of defaults that will

automatically be selected when adding a new record. The default information can

be changed by the user. As an example, if the customer address is automatically

entered as the state of Illinois, but the customer is in Indiana, the user can

change it.

Area Code. The area code that will be automatically

displayed when entering the phone number of a new customer or maker.

Zip Code. The zip code that will be automatically

displayed when entering the address of a new customer or maker.

City. The city that will be automatically displayed

when entering the address of a new customer or maker.

State. The state that will be automatically

displayed when entering the address of a new customer or maker.

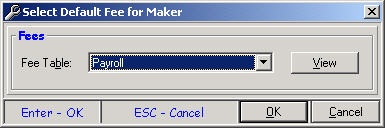

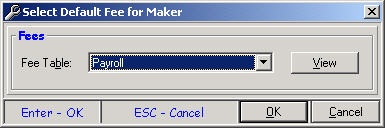

Default Fee for Maker

SigCard allows for a default fee to be assigned

automatically when a new maker is added. This default value does not affect any

existing makers.

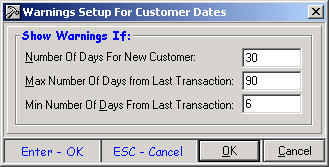

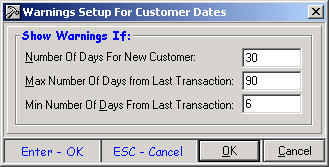

Warnings Setup

Customer and Maker Dates

SigCard can track elapsed time since the last activity

of a customer or maker and the number of days since the customer or maker was

added to the system. You will probably want to know if there has been very

recent activity, especially on the part of the customer, or if there has been

no activity for quite some time. You can determine these lengths of time by

entering in minimum and maximum days for the customer and maker files.

Number of Days

for New Customer: Warning occurs

when a customer has recently been added to the system.

Max Number of

Days from Last Transaction: Warning occurs when there have been no recent

transactions. If a customer has not recently cashed any checks, you may want a

warning to occur when the customer does come in after a significant amount of

time.

Min Number of

Days from Last Transaction: Warning occurs when there is recent activity

for the customer. If a customer has recently cashed a check, you may want a

warning to occur.

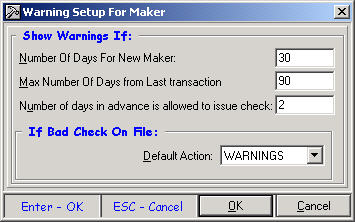

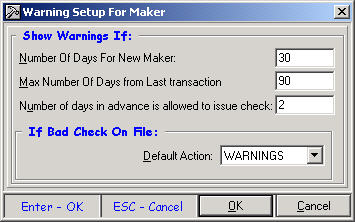

Number of Days

for Maker Customer: Warning occurs when

a maker has recently been added to the system.

Max Number of

Days from Last Transaction: Warning occurs when there have been no recent

transactions. If a maker has not recently had any transactions, you may want a

warning to occur when the maker is part of a transaction.

Number of days

in advance is allowed to issue check: Number of days prior to the date the

check was issued that the check can be cashed.

Default Action: Automatic action to take if the maker has a bad

check on file. Warnings can be displayed

or checks for that maker can be blocked if the maker has a bad check on file.

Supervisor Password

This is used to enforce a limit over which the teller

needs managerial approval to cash the check.

For information on how to setup and enforce a teller check limit, click

the following link.

http://www.dcsorg.com/whats_new/5.4.1.51%20changes.htm#_5.)_Enforcing_a_teller_check_cashin

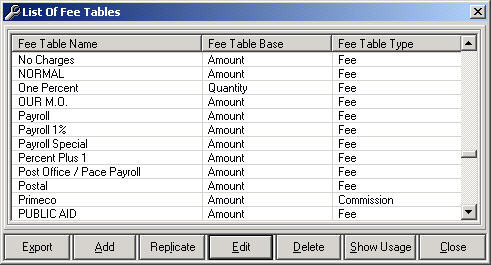

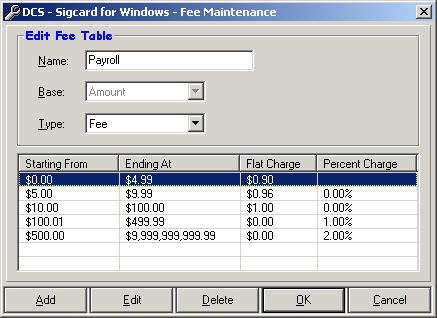

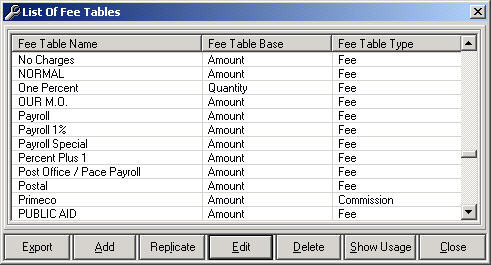

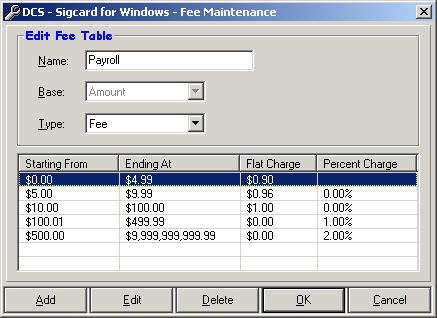

Fee Maintenance

SigCard is a flexible software product. It allows you to add as many fee tables as

needed. When a fee table is added, a Fee

Table Name, Fee Table Base, and Fee Table Type must be specified.

You will then need to setup one or

more brackets or fee ranges for each fee schedule and setup the associated

charge(s). Specify a Start From figure

for the range and a flat charge, percent charge, or both and select OK. Once this is done, the Ending At figure

will automatically be calculated. If

zero is specified as the Start From, then the Ending At figure will be

infinity or all nines. In certain

instances, there will be more charges associated with a fee schedule. For example, if there is another charge for a

$100, a second range must be added by selecting the Add button. Specify the Start From range as $100 and

the associated flat and/or percent charge.

Once the $100 range is added, the previous range will calculate a new

Ending At amount of $99.99 and the new Ending At amount for the $100 range

will be infinity or all nines.

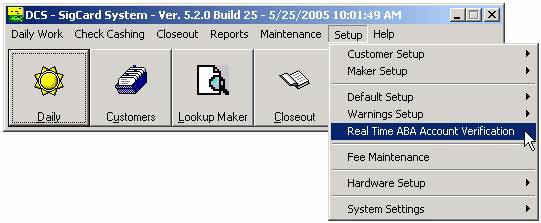

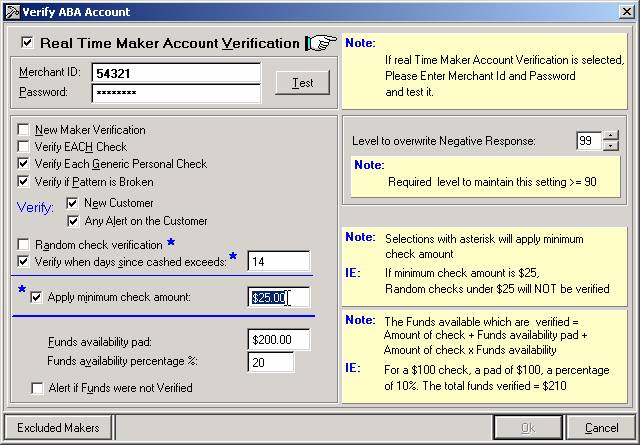

Real Time ABA

Account Verification

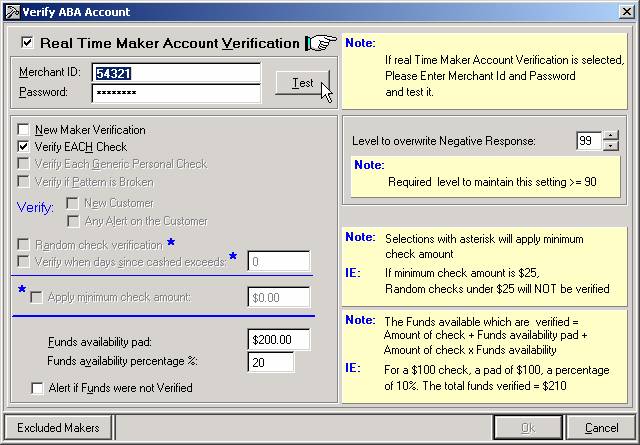

Enter settings to

enable check verification services.

Click on the Setup menu and choose the Real Time ABA Account Verification option.

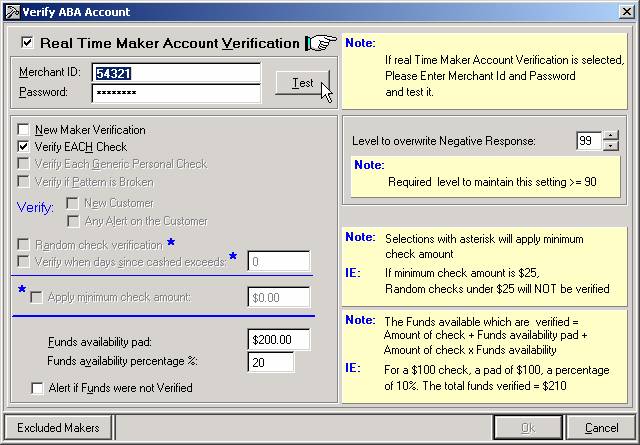

Enable ABA

verification by checking the box next to Real

Time Maker Account Verification.

Enter the Merchant ID and Password provided by ACH Direct.

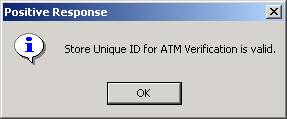

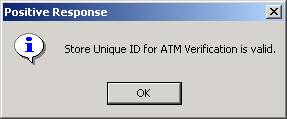

Click the Test button.

The image above is

displayed while the ID and password are verified.

A positive

response message appears if verification is successful. Click OK

to continue.

A response like the one above

indicates a failed verification.

Re-enter the Merchant ID and Password and try again. Be sure to use correct capitalization as

these fields are case sensitive. Contact

ACH Direct if the problem persists.

The remaining fields allow for detailed

control over which checks are verified and which are not. Limiting certain checks avoids unnecessary

verification and speeds up the check-cashing process.

New Maker Verification Run

verification on all new makers.

Verify EACH Check All checks are

verified. The rest of the fields are

ignored.

Verify Each Generic Personal Check

Verify all generic personal checks.

Verify if Pattern is Broken Verify if maker does not match normal

pattern for a certain customer- ie: Normal amount of check is $500, but this

time the check received is $5,000.

New Customer Verify checks for new

customers.

Any Alert on the Customer Run

verification if a warning is tied to this customer.

Random Check verification Checks are

randomly verified if they are above the amount entered in the Apply minimum check amount field.

Verify when days since cashed exceeds If customer has not cashed a

check for the number of days entered here, the check is verified. (Check must also be above the amount entered

in the Apply minimum check amount

field.)

Apply minimum check amount Check this

box and enter the minimum value.

Selections with an asterisk do not verify checks below this amount.

Funds availability pad Enter a value to verify sufficient funds in

the account. The amount verified is

determined by the formula described on the right side of the screen.

Funds availability percentage %-- Works together with the

availability pad to verify sufficient funds in the account. The amount verified is determined by the

formula described on the right side of the screen. NOTE-

IMPORTANT- At this time, a specific amount of funds can NOT be verified on most

accounts.

Alert if Funds were not Verified Available funds cannot be

verified. Checking this box alerts the

user when this is the case. The default

value for this is OFF. The reason for this is that at this time,

MOST accounts can NOT have funds verified.

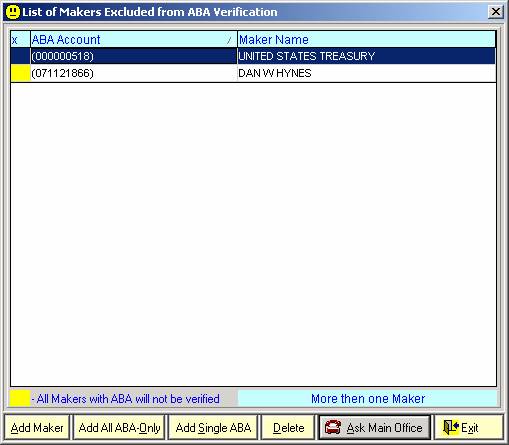

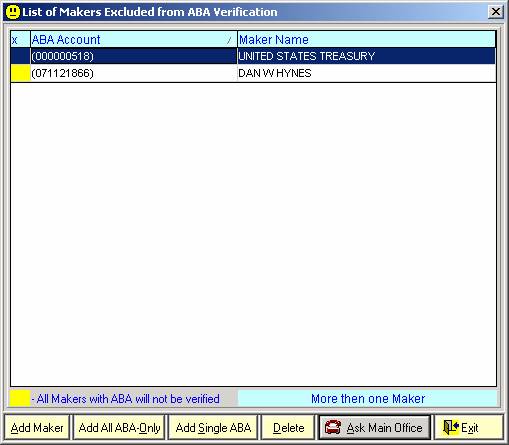

Excluded Makers Some makers are

generally safe and do not need verification.

Additionally, any ABA-ONLY checks can NOT be verified.

Clicking this

button brings up the following window.

Any maker listed

here will not be verified. Use the

buttons at the bottom of the screen to choose which makers are included in this

list.

Add Maker Lookup and add a maker to

the list.

Add All ABA-Only Fills the list with

any maker where ABA Only is checked.

Add Single ABA Lookup and add a single

ABA account number to this list.

Delete Remove the highlighted entry

from the list.

Ask Main Office Click here to check

with main office for recommended makers.

The list will fill in with accounts that are generally safe.

Exit Return to previous screen.

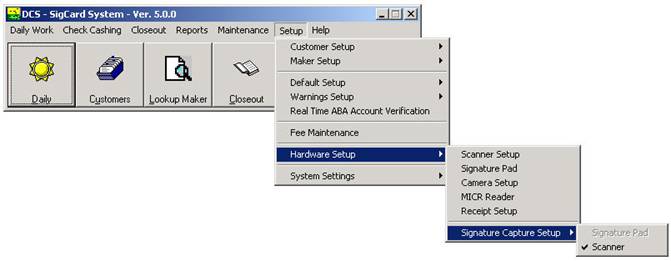

Hardware Setup

There are a number of hardware settings that need to

be defined in order for SigCard to work properly.

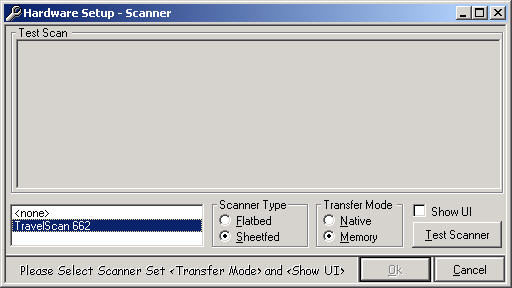

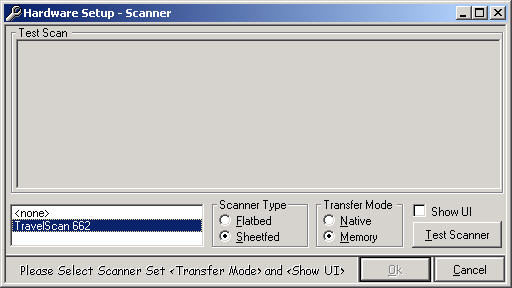

Scanner Setup

A scanner is used to capture images of customer ids,

customer signature and maker checks (as a generic check). It must be a TWAIN

compliant scanner. Each scanner has a driver that must be installed prior to

setting up the scanner. Select the driver file for the scanner. Choose the

scanner type, either flatbed or sheet fed.

Select the Native transfer mode. Do not check Show UI. Once these

settings have been defined, test the scanner.

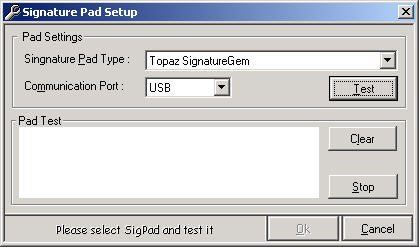

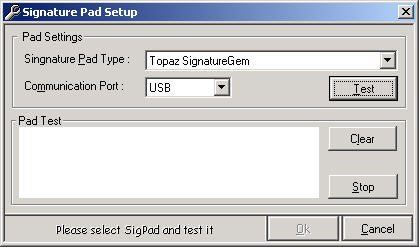

Signature Pad

A signature pad is used to capture the handwritten

customer signature when a new customer is added or each time a check is cashed.

Currently, SigCard uses the Topaz SignatureGem signature pad. Select the

signature pad type and the USB communication port from the drop down boxes. Once these selections have been made, run a

test to be sure the signature pad is working properly.

Camera Setup

Select the camera being used to capture the customers

image from the list. Selecting any of

the device settings buttons will allow you to adjust camera settings; such as

brightness, contrast, etc.

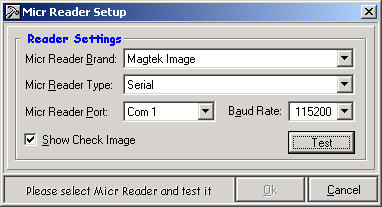

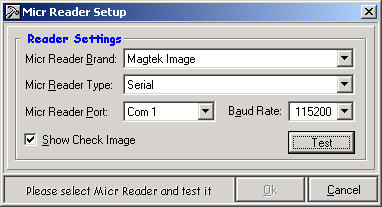

MICR Reader

The characters at the bottom of a check sometimes

referred to, as the MICR lines are the key by which all checks are

automatically processed in the United States today. A MICR (magnetic ink

character recognition) check reader will read the characters on checks to

identify the bank and account numbers. If an existing maker matches to the bank

/account numbers SigCard will display the maker record or a list of matching

records.

Micr Reader

Brand: The MICR reader manufacturer/model driver name.

Micr Reader

Type: The type of port used to connect the MICR reader.

Micr Reader

Port: The specific computer port used to connect the MICR reader.

Baud Rate:

The transmission speed used by the MICR reader.

Show Check

Image: Displays the check image after it is scanned.

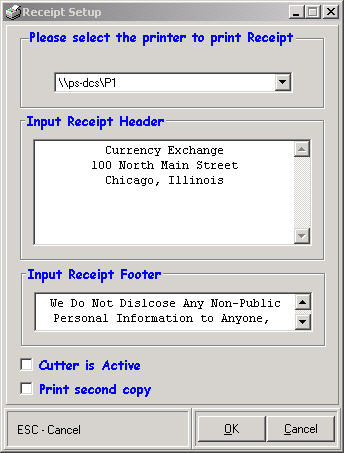

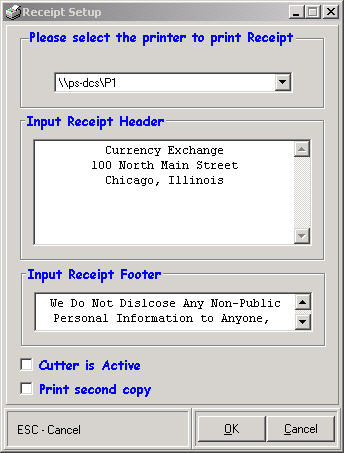

Receipt Setup

A printer can be setup to print the transaction

information after it is completed.

Printer:

Select the printer to be used to print receipts from the list of available

printers.

Header/Footer:

Information that will print at the top (header) or bottom (footer) of each

receipt.

Cutter is

Active: When checked, indicates there is an automatic cutter that will

slice the end of the receipt.

Print second copy:

When checked, a second receipt will print automatically.

Signature Capture Setup

SigCard can acquire customer signatures from either

the Signature Pad or the Scanner.

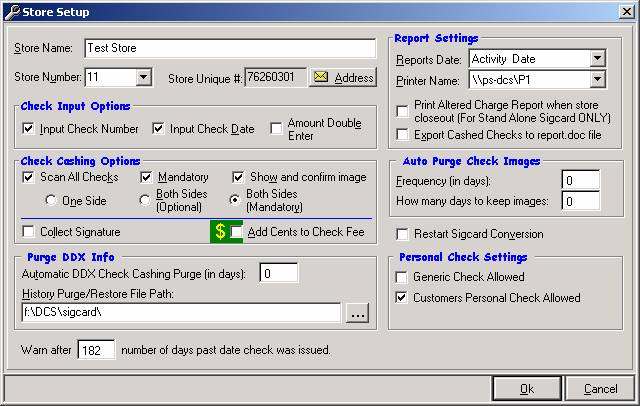

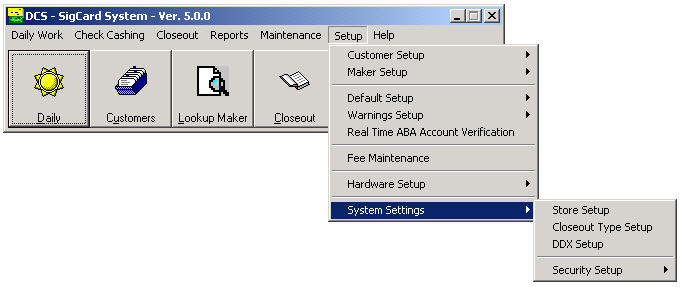

System Settings

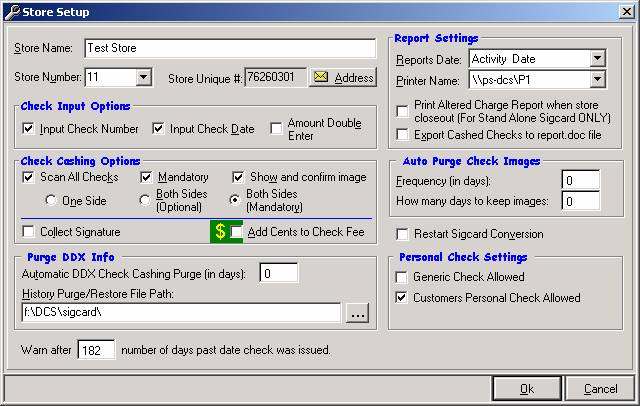

Store Setup

Store Setup is designed to give you options that can

be tailored to fit your own check cashing needs. Start by assigning a Store Name and Store

Number to the system.

Store

Name: This is the name of the store/currency exchange. User defined.

Store

Number: The number of the store/currency exchange. User defined.

Store

Unique Number: This value is determined by the DCS database. It can not be

altered from SigCard.

Report

Settings: Select whether the

Activity date, Session start date, or Session end date will be used on all

reports.

Printer Name:

Select the printer that will be used to print documents from SigCard.

Check Input

Options

Input Check

Number: When checked, the teller will be required to enter the check number

of the check to be cashed.

Input Check

Date: When checked, the teller will be required to enter the date the check

was issued.

Amount Double

Enter: When checked, the teller will be required to enter the check amount

as a double entry.

Check Cashing

Options

Scan All

Checks: When checked, all other check cashing options are enabled and can

be selected as needed. If no selection is made for one side or both sides

(optional or mandatory), then Both Sides (Mandatory) will be selected

automatically.

Mandatory:

When checked, the user will be required to scan a check before completing the

check cashing transaction.

Show and

confirm image: When checked, after the check is scanned the image will be

displayed and the user will confirm the image.

One Side:

When a check is scanned, only one side of the check could be scanned.

Both Sides

(Optional): When a check is scanned, both sides of the check could be

scanned.

Both Sides

(Mandatory): When a check is scanned, both sides of the check must be

scanned.

Collect

Signature: Used with Signature Pad. When checked and a Signature Pad is

installed, after a check to be cashed is scanned, the customer is required to

sign the Signature Pad and the electronic signature is saved with the check

image.

Add Cents to

Check Fee: Some stores have requested a special type of fee for check

cashing. The fee is first calculated according to a certain percentage or

following other formulas as it was previously. Then when the payout is

calculated, the cents part is added to the fee so that a round dollar amount is

handed to the customer.

Personal Check

Settings

Generic Check

Allowed: When checked, the Daily Work menu will include Cash Generic

Personal Check.

Customers

Personal Check Allowed: When checked, the Daily Work menu will include Cash

Customers Personal Check.

Print Altered

Charge Report when store closeout (For Stand Alone SigCard ONLY): When checked,

if any check cashing transactions were completed with a fee alteration, then

the Altered Charge Report will be printed when the store is closed out.

Purge DDX Info

Automatic DDX

Check Cashing Purge (in days): The number of days for automatic check

cashing purge.

History

Purge/Restore File Path: The full pathname for the file where the

purge/restore file will be saved.

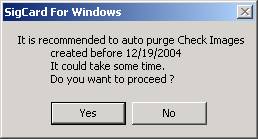

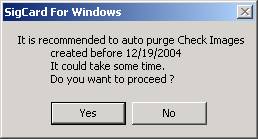

Auto Purge

Check Images

Frequency (in

days): This value is how often SigCard will look for check images to be

purged. This field works with the field How many days to keep images. When

SigCard looks for images to be purged it will use the value in the second field

to determine which check images to archive.

How many days

to keep images: This field is used

with the field Frequency (in days), to determine which check images should be

purged. When SigCard looks for images to be archived it will compare the value

in this field to the date of the transaction (when the check was cashed). Any

check images that are within the date range will be archived. This message will display prior to the purge.

The images will be stored in the file path defined in History Purge/Restore

File Path field, as \CHECK_IMAGES\yyyymmdd.zip (the file name represents the

archive date).

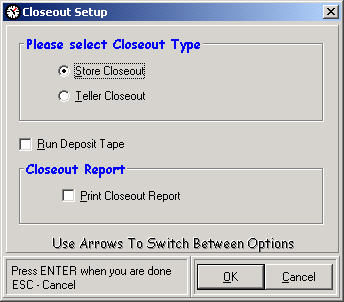

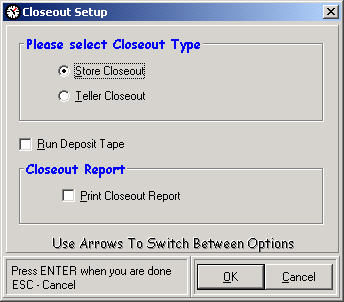

Closeout Type Setup

Closeout Type Setup lets you choose the

options you prefer for closeout.

Closeout Type: Select either Store Closeout or

Teller Closeout. The selected value will affect the items on the Closeout menu.

Run Deposit Tape: When checked, at the beginning of any

closeout, the teller will be requested to enter each check amount that was

cashed during the session. The total will be verified by SigCard and a deposit

slip with fees collected will be provided.

Print Closeout Report: When

checked, a report will be printed automatically after the closeout is

completed.

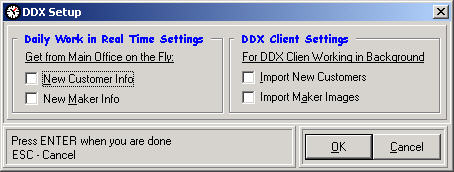

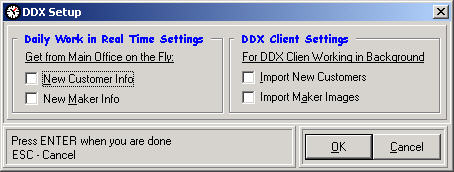

DDX Setup

The DDX Server is the digital backend communication

server for the database information, allowing information to be accessed freely

and efficiently, with the proper access privileges. DDX is used with multiple

stores running SigCard and/or main/back office environments that want to share

customer and/or maker information.

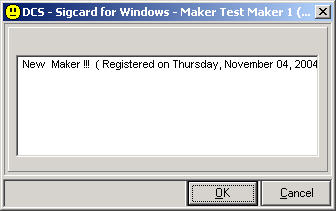

New Customer Info: When

checked, whenever a new customer is entered SigCard will automatically check

the Main Store/Back Office to see if the customer exists. If the customer does

not exist a new customer record will be created. This message will display.

New Maker Info: When checked, whenever a new maker

is entered SigCard will automatically check the Main Store/Back Office to see

if the maker exists. If the maker does not exist a new maker record will be

created.

Import New Customers: When

checked, new customer records will be imported from the Main Store/Back Office

to the remote stores. This is done in background and at timed intervals.

Import Maker Images: When

checked, new maker records will be imported from the Main Store/Back Office to

the remote stores. This is done in background and at timed intervals

digiCHECK.net Setup

In Sigcard version 5.4.1.53 and later, a new

service is fully integrated called digiCHECK.net. For information on available features or on how

to set this up, click the following link.

http://www.dcsorg.com/whats_new/5.4.1.51%20changes.htm#_1.)_digiCHECK.net_is_now_integrated

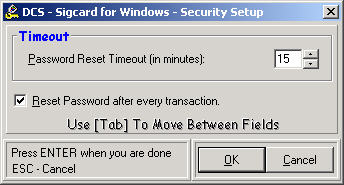

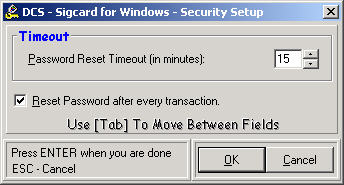

Security Setup

These options are unavailable to tellers.

Password

Setup

Password Reset

Timeout (in minutes): After the specified number of minutes of inactivity

the teller will be required to enter their password to gain access to the

system again.

Reset Password

after every transaction: When checked, the teller(s) would be required to

enter their password after each transaction. This is beneficial if multiple

tellers are using the same computer terminal, it assures that the transactions

will be associated with the proper teller.

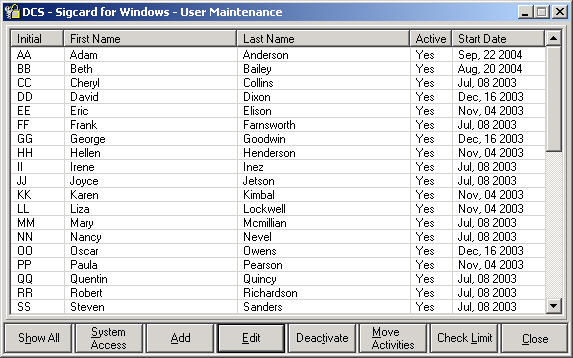

User

Setup

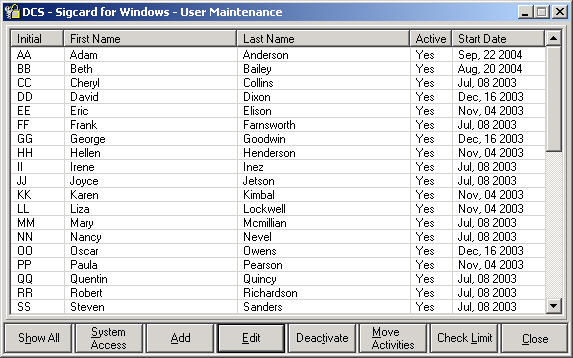

The User Maintenance screen is used to setup

individual user or teller logins. From

this screen you are able to assign users a login name, password, access rights,

and check cashing limits.

Show All. Display all user logins including all logins that have been

deactivated.

System Access. Set user access levels with 99 being the lowest level of

security with the most access rights and 1 being the highest level of

security with the least access rights.

Add. Setup a new user login and password.

Edit. Edit/modify a user login.

Deactivate. Remove an active user login so that the user may no longer

access SigCard.

Move Activities. Transfer all system activity from the selected user to

another user in the system.

Check Limit. Impose a single check cashing amount limit on a teller.

Close. Exit current User Maintenance screen.

Module Setup

This option is not yet available.

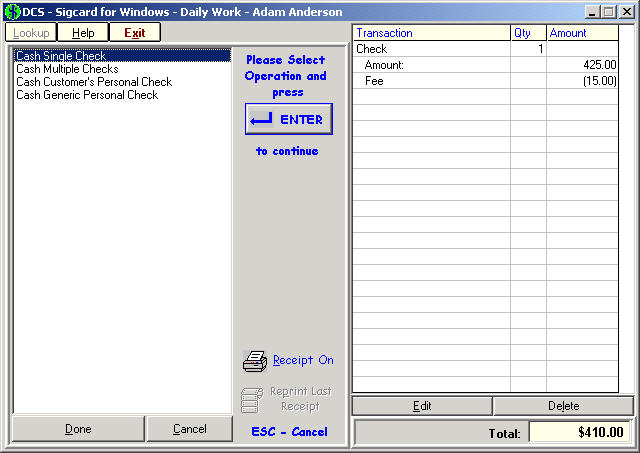

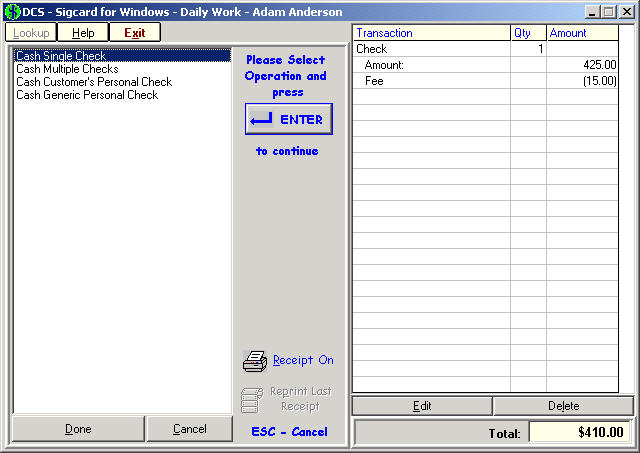

Daily Work

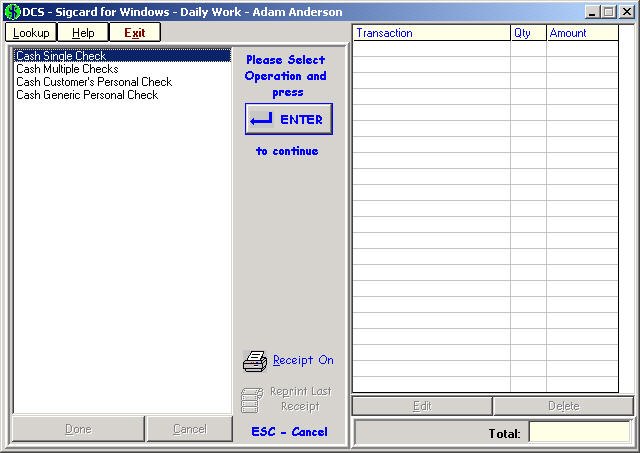

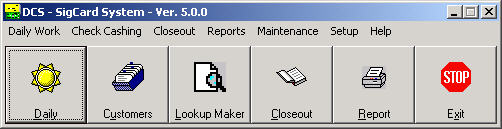

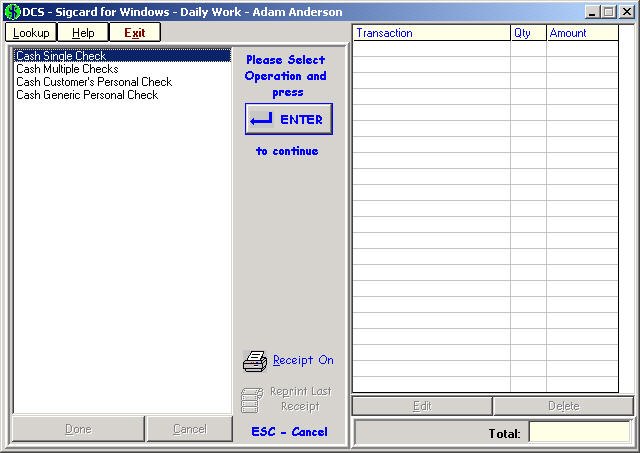

Main Menu

Main SigCard check cashing

screen. All check cashing can be done

through this screen or through the customers record. The left side of the menu allows you to Cash

Single Check, Cash Multiple Checks, or Cash Personal Check. By selecting Lookup, you are able to search

for and view a particular Maker. The

middle portion gives you the option to print a receipt for each transaction or

to reprint a receipt for the previous transaction. The right side of the menu shows a

transaction breakdown with the transaction type, quantity, amount, associated

fee(s), and the total for all transactions during the current session.

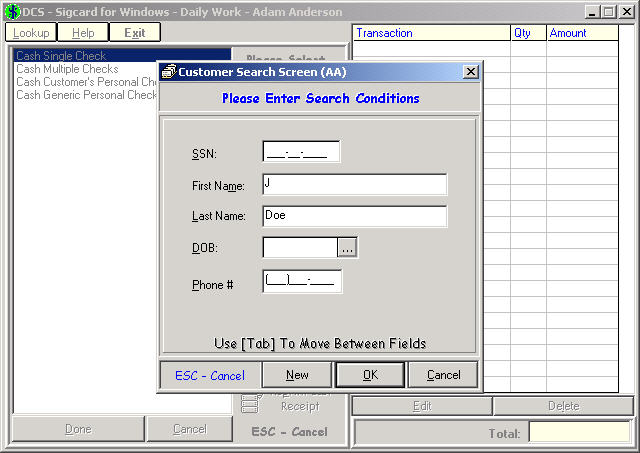

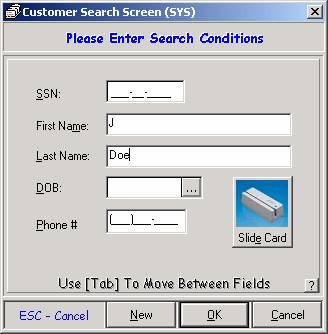

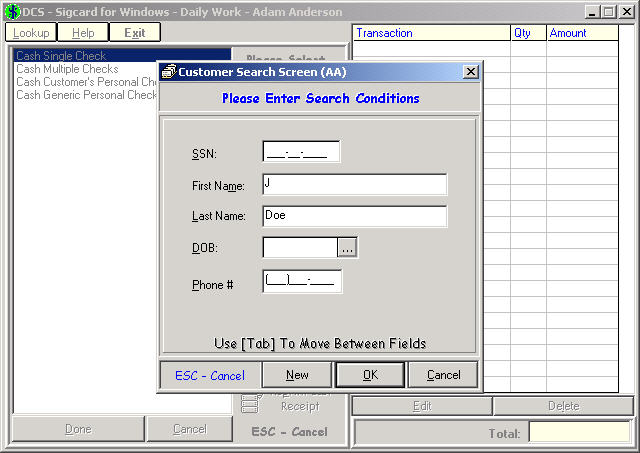

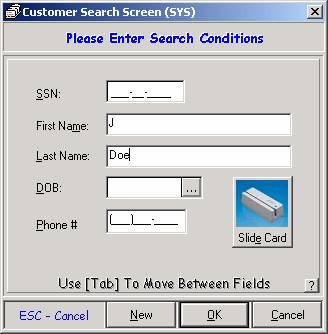

Customer Search

Screen

Whenever a check cashing

transaction is selected, the Customer Search Screen will be displayed. Enter a

portion of the customer information to perform the search and select the

customer record. Refer to the Customer

Menu for a detailed explanation on how to enter search criteria.

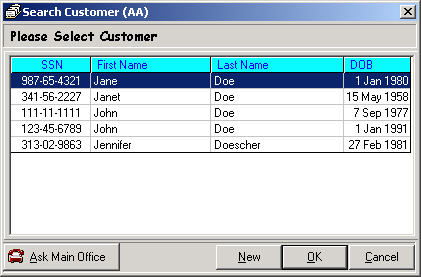

If multiple matches are found, a list of the matching records will be

displayed.

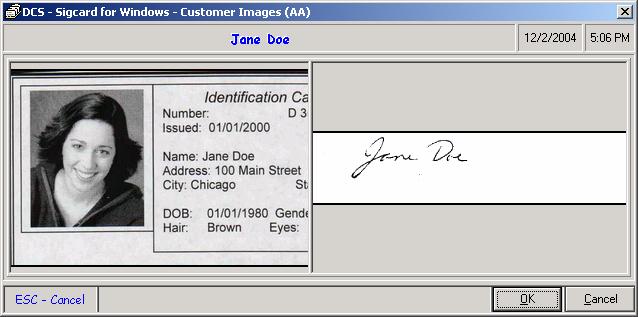

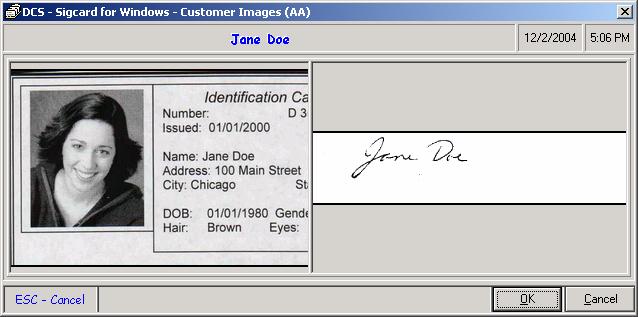

Customer Images

SigCard can scan customer

identification cards (driver license, state ID, student ID) and store the image

with the customer information. If any images are available, when the customer

is found in the database, they will be displayed. This could include; a digital

image of the customer taken with a digital camera, any customer IDs, and/or an

electronic signature. Any, warnings associated with this customer will also be

displayed. Once the warnings have been read, press the key that is displayed in

the scrolling text at the bottom to continue.

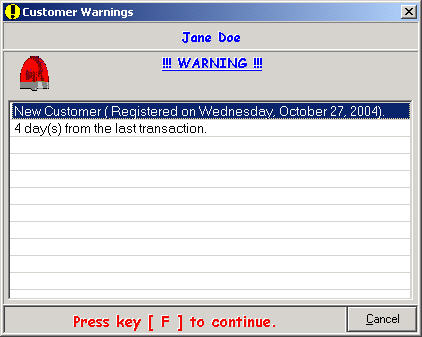

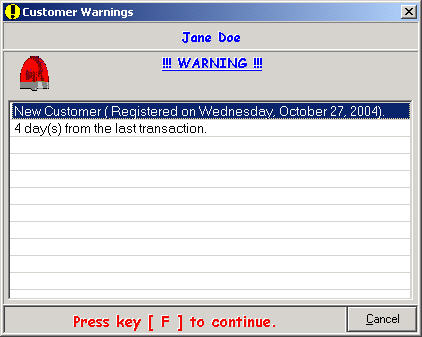

Customer Warnings

SigCard has several optional

warnings that can be activated. Customer warnings are based on the number of

days that have passed since a specific event has occurred. There are warnings

for new customer and last transaction events. If a customer meets the

timeframe, a warning message will be displayed prior to the customer

information screen. Once the warnings have been read, press the key that is

displayed in the scrolling text at the bottom to continue.

Customer Warnings

may appear prior to the Customer Information Screen.

To continue,

press the key for the letter that appears in red.

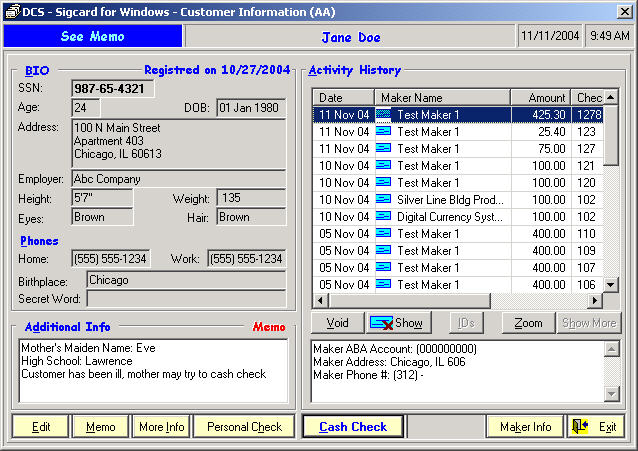

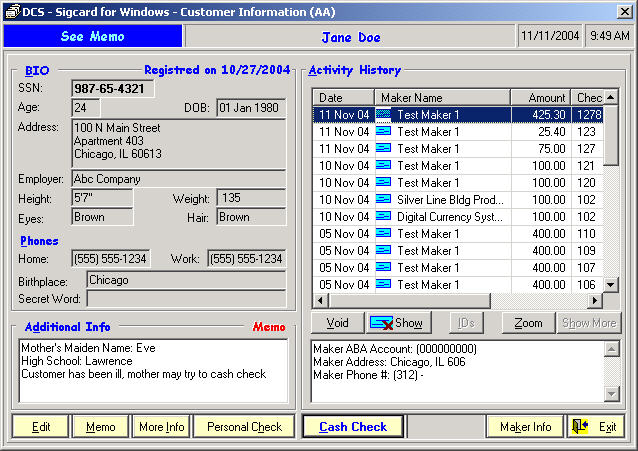

Customer

Information Screen

The Customer Information

Screen is displayed after a completed Customer Search has matched to an existing

customer record. This screen is used to enter a new customer, update an

existing customer and to process a check cashing transaction.

Whenever you choose a Cash

Checking transaction from the Daily Work menu or click on the Customer toolbar

icon; the Customer Information screen is displayed. This is where you will scan

an image of the check and record the check information.

Note: Refer to Customer

Menu for detailed explanation on all screen functions.

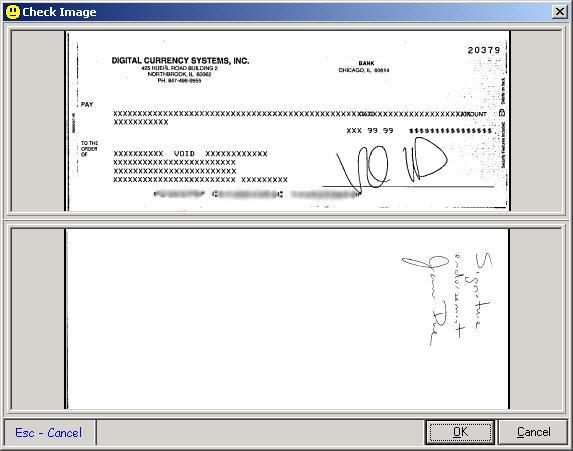

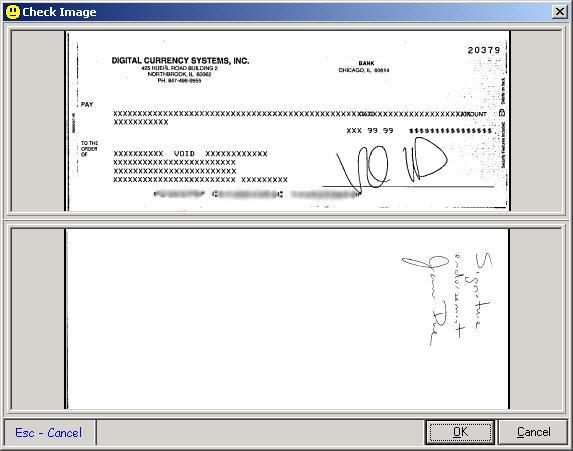

Check Image

From the Customer

Information screen, a check image can be acquired by scanning the check through

the MICR reader.

1) Slide the check through the MICR reader

with the front of the check facing the machine.

2) Look at the image, to verify that it

scanned properly.

3) If

you are satisfied with the image, scan

the back of the check if required.

4) Click OK

Warnings may occur to inform you of recent activities

related to the maker or the specific check.

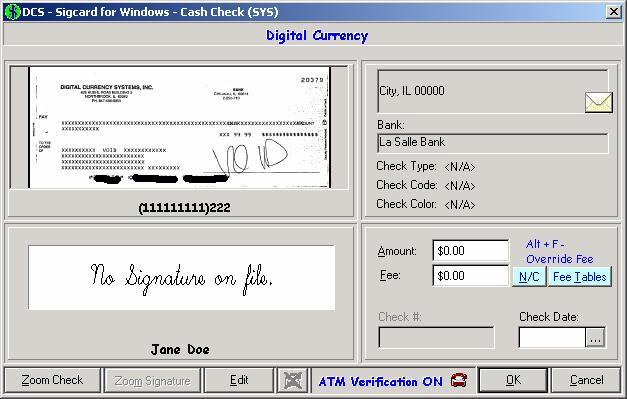

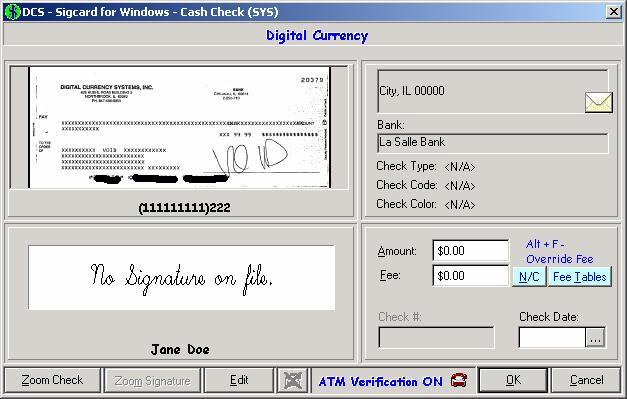

Cash Check

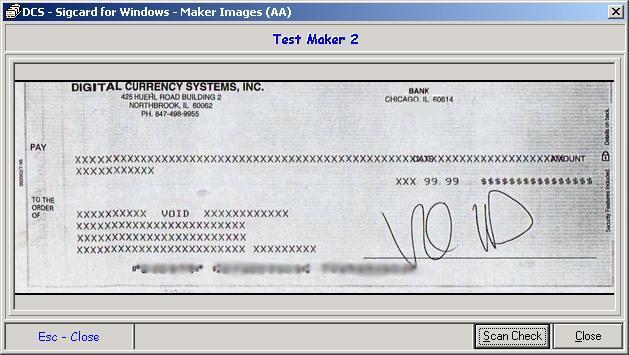

Once the check has been

scanned, the Check Cashing screen displays the Maker check image and Maker

information, the customer signature (if one is on file), Bank information, and

check description.

Once these are reviewed, the

check amount, the associated check fee, check number, and check date must be

entered. The default maker fee will be used but can be overridden by selecting

Fee Tables and choosing a different fee to cash the check.

ATM Verification

ATM Verification is turned on or

off based on settings in Real Time

Maker Account Verification.

For the check in this example, verification is turned on.

When verification

is turned off, click on the red phone to override system settings.

Once the check

amount and date have been entered, the maker account is verified with ACH

Direct.

The image above is

displayed while your computer connects to the ATM network.

Green Light

Several responses are possible

based on current data for this maker.

The green light indicates:

1) The

account is open and valid

2) The

account is not overdrawn (positive funds)

3) The

check being verified has not been reported as stopped

4) Funds

verification ONLY IF such verification is available for the account. At the time of this writing, most accounts

can NOT have funds of a certain amount verified. If you are interested in this information,

then you should insure the Alert

if Funds were not verified checkbox is CHECKED.

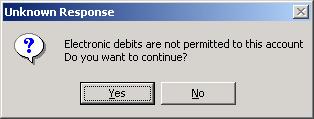

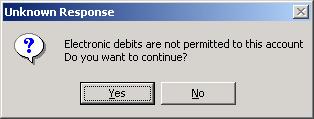

Yellow Light

A yellow light means proceed with

caution. An additional message box explains why

this maker received the cautionary response.

As an example, the above would indicate that the account is good, but

electronic debits are not allowed. This

could be quite normal, as is the case for many company payroll accounts. This would probably be considered negative

information with respect to personal checks.

Another common reason for a

yellow light is no useful information is available. This would indicate that no information at

all was found for the account.

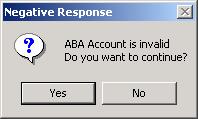

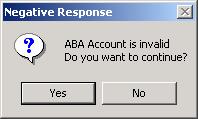

Red Light

Similar to the yellow, a red light

is accompanied by a message box explaining why this maker got the negative

response. In the example above, the ABA

Account number is invalid. Other red

light examples are insufficient funds, stopped checks, and closed accounts.

Cashing a check

that receives a red light is usually not recommended.

A word on Check

Verification:

Although

we at DCS feel this is a useful tool, it should be considered exactly that: a

tool. A green light does not mean that

the check should be cashed- it simply means that the check passed criteria

which are stated above. Conversely, a

red light does not always mean that a check should not be cashed. The system verifies checks against actual

accounts at banks which are participating members. Should a bank not participate, the system

attempts to verify the check utilizing a nationwide negative-check

database. Negative databases provide

information which is not always accurate and not always applicable.

At

the time of this writing, participation by Banks runs as high as 80% in Western

States, and around 35% in Mid-Western States as an example. The check verification information is

provided by a third party processor with whom you need an agreement.

DCS does not guarantee the accuracy of check verification information,

nor does DCS assume any responsibility or liability for it's use.

Manager Approval

Based on certain criteria,

such as amount or type of check, it may be necessary for a manager to approve

the check before it can be cashed. There

are two new features available (in version 5.4.1.53 and later) that enforce a

teller check limit and make it possible for off-site managers to approve checks.

The following link contains

information on setting up a check limit and how this is enforced using a

supervisors passcode.

http://www.dcsorg.com/whats_new/5.4.1.51%20changes.htm#_5.)_Enforcing_a_teller_check_cashin

Additionally, it is now

possible for off-site managers to view the check before approving it. This is done through a digiCHECK.net

service. For more information, click the

following link.

http://www.dcsorg.com/whats_new/5.4.1.51%20changes.htm#_2.)_Check_Approval_through_digiCHEC

Transaction List

Once the check has been

entered into the system, a transaction breakdown is shown on the Daily Work

screen. Other transactions can be entered, or if the customer has completed all

transactions, select Done.

The transaction

is complete.

The Daily Work

screen is displayed and ready for the next customer.

Customer information makes it easy to identify your

customers and track their check cashing history. Each customers file can

include name and address information as well as information for identifying the

customer. Identification information includes; a photo, signature,

identification card images, and contact notes. There is also a history of all

check cashing transactions which can include an image of the check that was

cashed.

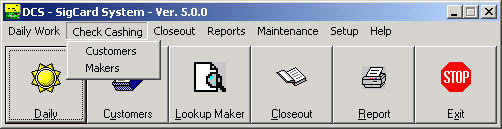

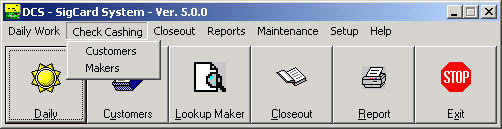

To access customer information, add a new customer,

cash a check, or to perform any other customer function, click on the Customer

icon or choose 'Customers' from the

Check Cashing menu.

Customer Search

The Customer Search screen is used to find an existing

customer or add a new customer. You should always search for the customer first

before adding them as a new customer. There are various ways to perform a

customer search. SigCard allows you to

look up a customer by name, social security number, birth date, and/or phone

number. Below is an explanation of search conditions.

SSN. Enter a portion of the customers social

security number or the entire customers social security number to retrieve a

list of customers with that number.

Name. Enter a portion of the customers name or the

customers full name. You may get undesirable results if you enter the

customers name and the name you enter differs from the way it is spelled in

the system. For example, if you search

for Jane Doe, but the customer information is Jayne Doe, you will not get a

correct match. To avoid this, expand the search by entering J as the first

name and Doe as the last name. A few more search results will be found, but

you will be able to select Jayne Doe from the results screen.

DOB. Enter the customers date of birth to

retrieve a list of customers with that birth date.

Phone. Enter a portion of or the entire

customers phone number to retrieve a list of customers with that phone.

Generally, the lesser amount of characters or fields

that are entered, the larger the search results or the more customers

retrieved. The more characters or fields

entered, the narrower the search results or the fewer customers retrieved. In

most cases, enter the information that you have on the customer and perform the

search. If undesirable search results

are retrieved, then perform a broader search on the customer by removing a

field or some characters from the search criteria that was entered. A combination of fields or just a single

field may be used to perform a customer search.

You may want to use last name and date of birth (DOB) to perform the

search or you may just want to search on Social Security Number (SSN). SigCard is flexible and allows you to perform

a search with any available information you have on a customer.

Slide Card. Anywhere you see the blue Slide Card button, the customer

information can be retrieved by sliding a Credit Card or Drivers License (in

states with magnetic stripe). The information stored on a Drivers License

varies depending on what State you are in.

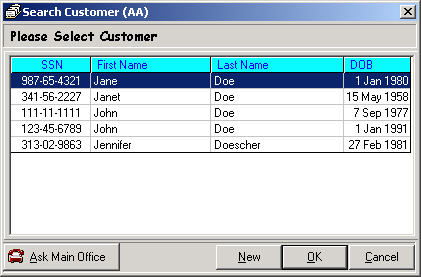

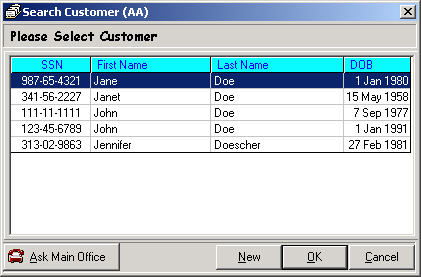

Customer Search Results

The customer search results will list multiple

matching customer records that were found using the search criteria that was

entered on the Customer Search Screen. From this screen you are able to add a

new customer or view an existing customers record.

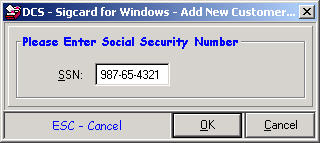

Add New Customer

To add a new customer,

choose 'New' from either the customer search screen or the customer search

results screen. Following is a list of the data fields in the customer record

that you will be asked to fill in.

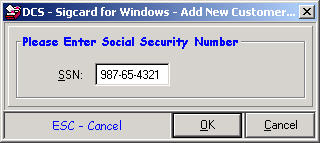

SSN The social security

number is a unique number assigned to an individual. You will be asked to

confirm this number to insure accuracy. SigCard will not allow you to continue

until both entries match. Social security numbers are supposed to be

unique, but there are some situations where the customer may not have a social

security number, or the number is used to represent a specific group of

individuals. For these situations, SigCard allows the use of a social security

number to be shared by those individuals.

Name. The first and last name of the customer.

Birth Date. The birth date of the customer in the format

MM/DD/YYYY.

Address. The street address, direction, and street name for a

customer. Note that 2 space areas separate this field into 3 smaller fields.

The address 1211 E. 19th Street would actually be entered as 1211 (Street

Address), E (Direction), and 19th Street (Street Name).

City. The city the customer

resides in.

State. The state the

customer resides in.

Zip Code. The customer zip code, which can accept an optional 4-digit extension.

Employer. The customer's employer name.

Height. The height of the customer, in the format 6'01".

Weight. The weight of the customer.

Eyes. The eye color of the customer.

Hair. The hair color of the customer.

Phone. The area code and phone number of the customer.

Additional Info. Enter the information associated with these user

defined fields.

Reverse

Telephone/SSN Lookup

It is now possible to verify

customer information once the phone number and/or social security number has

been entered. This is possible due to an

integration of Sigcard with digiCHECK.net.

For more information on how this works, click the following link.

http://www.dcsorg.com/whats_new/5.4.1.51%20changes.htm#_3.)_Lookup_customer_through%20reverse

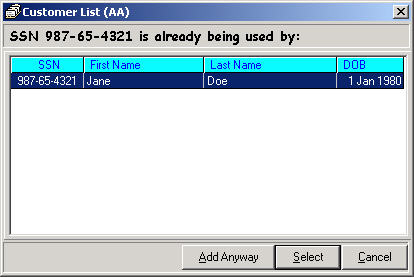

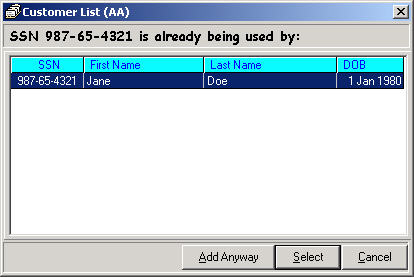

Duplicate

Social Security Numbers

A unique social security

number is issued to each individual. However, there are situations where the

use of a generic social security number is required. When a new social security

number is entered, SigCard, checks to see if that number is already assigned to

another customer in your system. If an

existing record matches or there are multiple matches, the list of matches will

be displayed. You can choose to Add Anyway and continue entering the new

customer with the existing SSN.

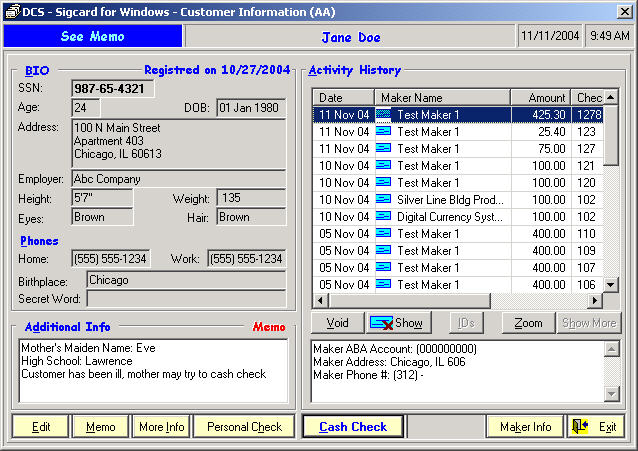

Customer

Information

The customer information

screen is used to enter a new customer, update an existing customer and to

process a check cashing transaction. There is additional customer information

that can be customized for your store such as mothers maiden name, birthplace

or other information that will identify the customer. A flag can be set for the

customer with a do not cash restriction, or details about the customer that

will help you serve them better. If the customer is blind or deaf, you may want

to have a memo in the record.

The left side of the screen

is the customer demographics portion of the record. The right side of the screen is the history

portion of the customer record. The functions are slightly different for each

side.

Customer Record

The left side of the screen

contains all of the basic customer information: name, address, physical

description, etc. If a flag has been set, it will display in the upper left

hand corner of the screen. Flags can be informational only (blind, deaf), a

reference to the memo section or a do not cash restriction

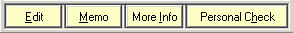

Menu Options

The menu options, Edit,

Memo, and More Info, are explained below:

Edit Allows you to modify

the customer information fields.

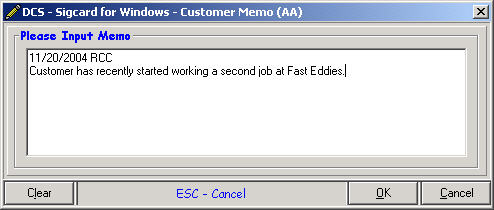

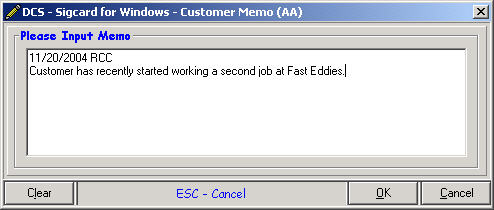

Memo Opens the memo text box

where you can enter comments about the customer.

The

recommended format for entering comments:

Date: MM/DD/YY

Initials: Teller

initials

Description

To remove an individual

memo, select the memo text with the mouse, press the delete key, and select

OK. To clear the entire memo screen, select Clear and then select OK.

More Info A pop up menu

appears with these items.

Add new. Allows you to add a new customer

record to the database,

IDs Allows you to enter or view customer

identification types and images.

Images Allows you to scan or view customer

photo, signature and/or check

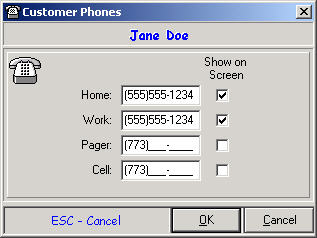

Phones Allows you to enter or view up to four phone

numbers

Flag Allows you to set an informational, memo or do not cash

flag

Additional

Information Allows you to enter

custom information

Print Profile Prints a profile of the customer record

Teletrack

Related to PayDay Loans. Provides a history of Teletrack information.

Exit Closes the pop up menu.

|

|

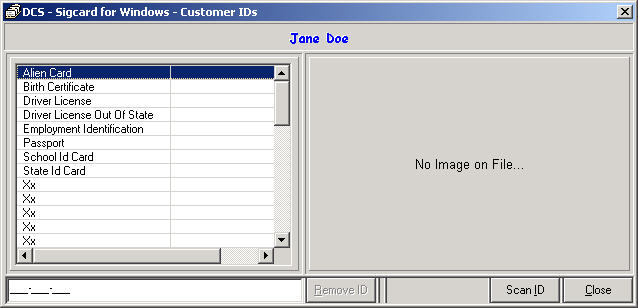

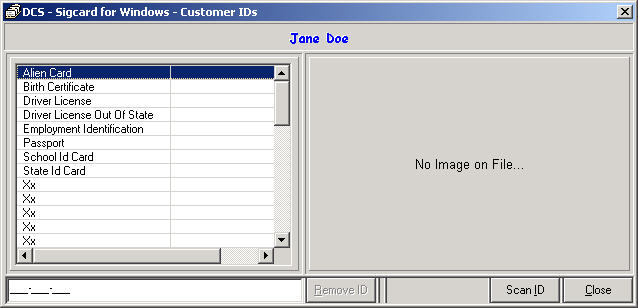

Customer IDs

Customer identification

types are user defined and there is no limit to the number of types you can define.

There is a 30 character identification value field that can be formatted to the

specific ID type. As an example, a drivers license begins with an alphabetical

letter, so the format could be A123-456-789. Each customer can have as many ID

types associate with it as necessary. You can also scan the ID to have an image

stored with the customer information.

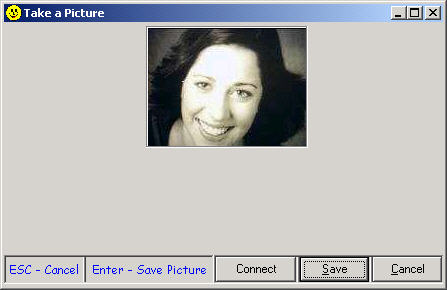

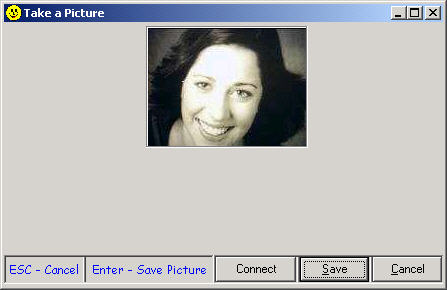

Images

You can take an image of the customer with the camera,

capture the customer signature with the signature pad, and/or scan the customer

signature using a scanner.

Take Picture

Align the customer with the camera and select Take

Picture.

Once you are satisfied with the image, select Save

and then OK.

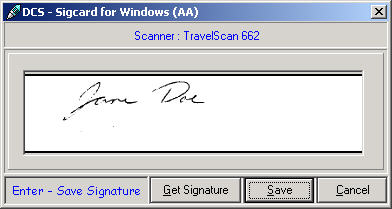

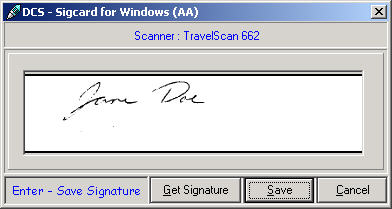

Get Signature

You can scan the customer signature card, or if you

have a signature pad you can capture the signature from the pad. When you are

satisfied with the signature scan, select Save and then OK. If you are not satisfied, adjust the image

and select Get Signature again until you get a good signature scan.

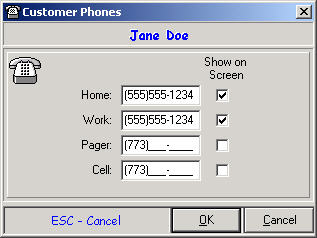

Phones

Up to four phone numbers can be entered for each

customer. Two of the numbers can be displayed on the customer information

screen.

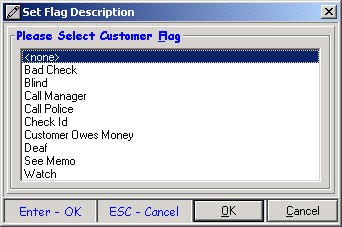

Set Flag Description

Customer flags are used for information, reference to

a memo, or to restrict the customer from cashing a check. Many flags can be

defined. Only one can be assigned to a customer at a time. If a flag is

selected that has Bad Check in its definition, the Cash Check button will not

enable and you will not be able to complete the check cashing transaction.

To flag a customers record, select the flag you wish

to use and then select OK. The flag

will appear in the upper left corner. If

there is to be no flag or to clear a flag, select <none>.

Customer Additional

Information

Additional customer information can be customized for

your store. There are unlimited custom fields that can be added. The

information will appear on the customer information screen in the Additional

Info section. This information can be used for security reasons or to verify

information.

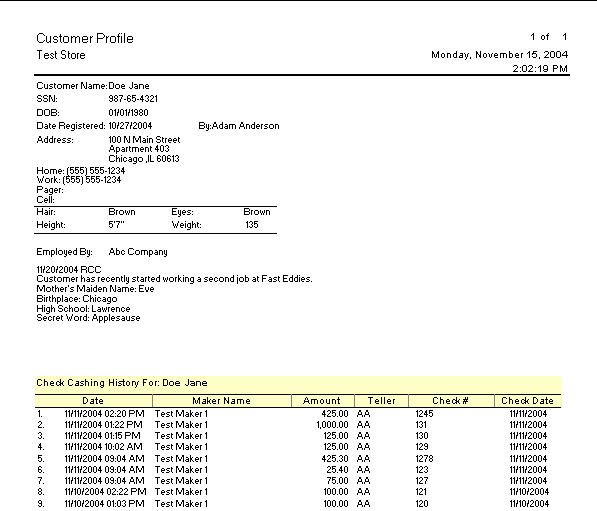

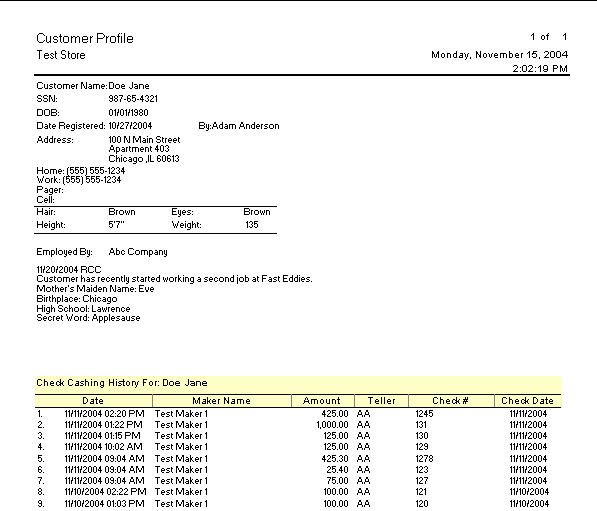

Print Profile

The customer profile includes the name and address of

the customer, as well as other information. The profile can be previewed on the

screen, or printed to the report printer.

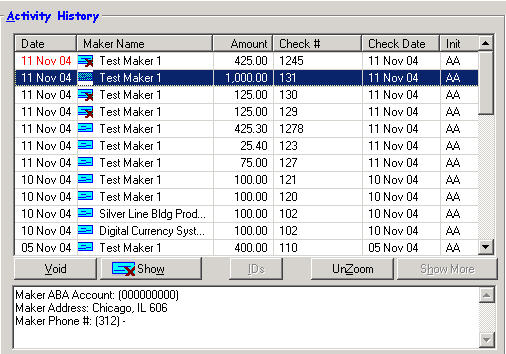

Check

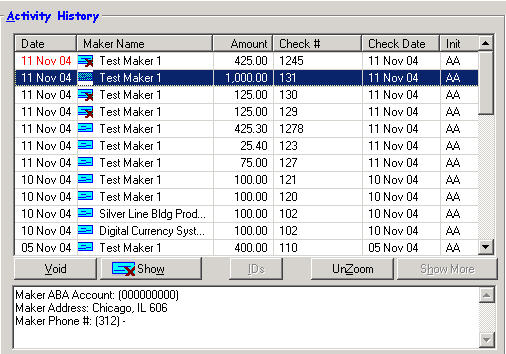

Cashing Activity History

The customer's check cashing

history is displayed in the upper right hand section of the Customer

Information screen. All check cashing transactions are listed, eleven are

visible at a time, starting with the most recent activity. Use the scroll bar

to view older transactions. For each check

cashing transaction SigCard displays the date of the transaction, the maker,

the check amount, and the initials of the teller who recorded the transaction.

In addition, if the check number and/or the check date was entered, this

information will also be displayed. You can void a check transaction from the

list by selecting Void. If the check was voided, the date of the transaction

will appear in red. A transaction can only be voided on the same day it was

presented to be cashed. If the check was scanned, the Maker Name will include a

blue icon and the image(s) can be displayed by selecting Show.

digiCHECK.net

- Check Image Archive Service

digiCHECK.net is now

integrated with Sigcard and offers a variety of services. The Check Image Archive Service stores all

check images on the digiCHECK.net web server. The user can then access a customers check

history from other locations. For more

information, click the link below.

http://www.dcsorg.com/whats_new/5.4.1.51%20changes.htm#_4.)_Lookup_and_view_check_through_d

Maker

Information

Below the Activity History

is a section that includes information about the specific check maker for the

selected transaction.

Options

Void/Unvoid. Allows

you to void or unvoid a check in history. This can only be done before a

closeout has been completed that would include the specific transaction. The

transaction date will appear in red for a check that was voided.

Show. If the check

and/or signature were scanned into the system when it was cashed, a blue check

image will appear next to the maker name in the check history. By selecting Show, you are able to display

and print the check and/or signature image.

IDs. Allows you to

view all IDs that have been scanned into the system for the customer.

Zoom/Unzoom. Allows

for full viewing of the entire activity history screen.

Cash Check. This

option allows you to cash the customers check.

See the Daily Work Customer Info

screen section for a detailed explanation on the check cashing

procedure.

Show More. Future

enhancement - not yet available.

Maker Info. This

option will display the Maker Information screen for the selected check.

Refer to the section on Makers for more information.

Exit. Close and exit

the Customer Information screen.

A maker is the actual bank and account where the check

was issued. The maker file is as important as the customer file. Several

customers may have checks issued against the same maker, as an example, a

payroll account. Verification of maker information is important. DCS offers an

ATM Verification option, which may or may not be at your store. Once you verify

a maker, the information should be stored or updated in the maker file. You

will be able to track makers that have a history of bad or bogus checks and

make sure you do not cash checks for a bad risk in the future. To access a

maker file, select 'Makers' from the SigCard Main menu, or choose Lookup Maker.

Maker Search

A maker record is accessed using the Maker Search

Screen. Enter a portion of the maker information to perform the search and

select the maker record from the results. If you are using a MICR-reader, you

can look up the maker by scanning the check through the reader.

ABA Account

Enter a portion of or the entire ABA number to retrieve a list of makers with

that ABA. You can also scan a check through the MICR-reader and the ABA number

will be read into this field.

Company Name

Enter a portion of or the entire company name.

First Name

Used to look up Personal Check accounts. Enter a portion of or the entire first

name.

Last Name

Used to look up Personal Check accounts. Enter a portion of or the entire last

name.

Note When entering search criteria, the more information

or fields entered, the more concise the search results. The less information or

fields entered, the broader or more general the search results. Partial entries or a combination of partial

field entries may be used, or complete entries or fields may be used to perform

the search depending on how broad or narrow you would like the search results.

Search Maker

The following screen displays the maker search results

that were found using the search criteria that was entered on the prior Maker

Search Screen. From this screen you are

able to add a new maker or view an existing makers record. To view an existing

Maker, select the maker from the list and press Enter.

Add New Maker

To add a new maker, choose

'New' from the maker search screen. Following

is a list of the data fields in the maker record that you will be asked to fill

in.

ABA/Checking Account Number. The combination of the bank's ABA

number and the maker's checking account number creates a unique number for each

maker, with some occasional exceptions (see Duplicate ABA numbers, below).

Because of the importance of this number in identifying the correct maker,

SigCard forces you to enter it twice for verification, just like the customer's

social security number. You can only continue adding the rest of the maker

information if you key in the number correctly both times. If you are using a

MICR-reader, scan the check when asked to input the number. Use of an

electronic reader will eliminate human error.

Company Name. Enter the company name, exactly as

it appears on the check.

Contact Name. A contact name

for the above company.

Phone. The area code and

phone number of the company.

Fax. The area code and phone

number of the fax at the company.

Address. The address field

actually consists of 3 smaller fields: Address, Direction and Street Name. For

a company residing at 1200 W. MAIN, the address would be

1200, the direction would be W. and the street name would be MAIN.

2nd Address. An additional address

line is supplied, for a Suite No., Office No., etc.

City. The city the company

resides in.

State. The state the company

resides in.

Zip Code. The company zip

code, which can accept an optional 4-digit extension.

Fee Table. The fee schedule

associated with all transactions for the maker.

Bank Info.

Bank Name. The name of the bank issuing the check for

the company.

Address. The address of the bank issuing the check for

the company.

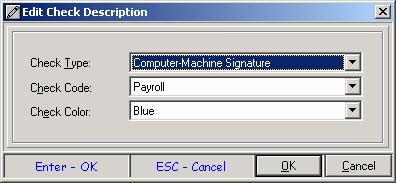

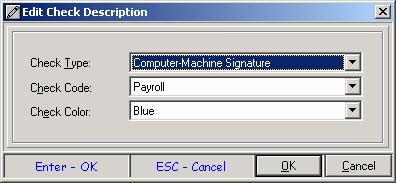

Check Description. A

physical description of all checks associated with the maker.

Duplicate

ABA Numbers

An ABA number uniquely

identifies a maker. A government agency will often use the same ABA number for

multiple service accounts. The United States Treasury uses the Federal Reserve

Bank with the ABA number of 00000518. Another bank may provide payroll service

to their clients. You can have a situation where there will be several

different companies all registered with the same ABA number, since the maker is

really the bank and not the company! SigCard provides you with an easy way to

distinguish whether or not this is the case; you can use the 'ABA Only' field

to identify the company check as a "payroll service" check versus a

normal payroll check. This option is used

when the bank is initially setup in the system through the maintenance menu.

Maker

Information

The Maker Information

screen has many functions. This screen

can be used to edit a makers record, view the makers check cashing history, maintain

maker check images, impose check cashing limits, and various other maker

functions.

Maker Details

The left side of the screen displays all of the basic

information about the maker; name, address, ABA/Checking Account number, and

general bank information established when setting up this maker.

History

The right portion of the 'window' displays the most

current checks cashed for this maker. To view more transactions, use the scroll

bar to move up or down.

Menu Options

Edit Allows you to edit basic information about

the maker.

Memo Just as you can record a memo or a note on a

customer record, you can also record a memo on a makers record. The same

format applies:

Date: MM/DD/YY

Memo: Free form description

Initials: Teller

initials

To remove an individual memo, select the memo text

with the mouse, press the delete key, and select OK. To clear the entire memo screen, select

Clear and then select OK.

Once you have entered the memo, the word Memo will

show up in red to indicate that there is a memo for this maker.

More Info The 'More' option allows you to add a new

maker; edit the existing maker; scan the maker's signature; set a flag for the

maker; or print the maker's history.

Add New Allows you to

add new makers. Refer to the Add New

Maker section.

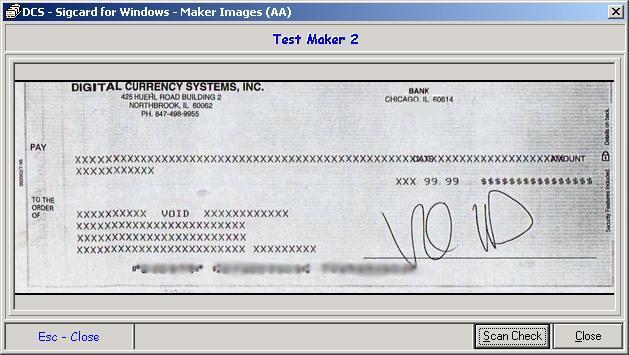

Images Allows you to

scan and store a reference color image of the check for the maker. This is useful when you are cashing the

customers check, you are able to view an image of a check from their

maker. Scanning a check is very similar

to scanning customer IDs. Select Scan

Check twice and then select Save to save the check image for the maker.

Bogus Checks Allows

you to scan and store an image of a bogus check that was attempted to be cashed

for the maker. Once Add or Edit is

selected, refer to the image scanning above for an explanation on the scanning

procedure to save a check image.

Check Description

Allows you to provide a physical description of all checks cashed for

the maker. Use the drop down boxes to

choose descriptions from the lists provided.

Link To Customer

Allows you to link a specific customer to the maker.

Flag Allows you to

flag a makers record using one of the pre-defined flags.

Set Flag Description

Maker flags are used for information,

reference to a memo, or to restrict the customer from cashing a check for a

specific maker. Many flags can be defined. Only one can be assigned to a maker

at a time. If a flag is selected that has Bad Check in its definition, the

Cash Check button will not enable and you will not be able to complete the

check cashing transaction.

To flag a makers record,

select the flag you wish to use and then select OK. The flag will appear in the upper left

corner. If there is to be no flag or to

clear a flag, select <none>.

Warnings Will display

any warnings that are in place for the maker.

Such as the maker being flagged, an extended length of time from the

last transaction, etc.

Bad Checks Allows you

to flag the maker record if a bad check is on file. If this option is checked, the words Bad

Check will appear in the upper right corner in red.

Show Statistics.

Provides a breakdown of check amounts cashed for the maker. Breakdown will show stats such as smallest,

largest, or average check amount, weekly number of checks, weekly dollar

amount, and check cashing frequency by day.

Print Profile. Allows

you to print maker information in full detail and will show general maker

information to check images and the maker check cashing history.

Bank Maintenance.

Refer to Bank Maintenance under the Maintenance menu for a detailed

explanation on this option.

Exit. Leave the More

Info menu and return to the main Maker Info screen.

Check Limit Check cashing limits can be imposed on total

amounts for a single check, daily check amounts, and weekly check amounts for

any given maker. The defaults that were

initially setup will appear but can be changed.

Show If the check and/or signature were scanned

into the system when it was cashed, a blue check image will appear next to the

maker name in the check history. By

selecting Show, you are able to display and print the check and/or signature

image.

Customer

Info Allows you to view general

customer details about the check cashed and the customers address. Optionally, you are able to access the entire

customer record to view customer details or view the customers check cashing

history.

Exit Leave Maker Information screen.

SigCard has two types of Closeout methods: Teller Closeouts and Store Closeouts. Teller closeouts allow each individual teller

to closeout their own drawer totals separately.

Store closeouts will closeout the totals for all teller drawers at one

time. The Closeout type that your system

is using was determined during the initial SigCard setup.

Teller Closeout

There are two types of teller closeouts: Total Check Closeout and Deposit Tape

Closeout. The total check closeout is a

one time total check amount entry that will closeout the tellers drawer. The deposit tape closeout is a check by check

amount entry that will closeout the tellers drawer after each individual check

amount has been entered.

Total Check Closeout

Enter the total amount of all checks cashed. If the your total does not match the total

the system calculated, you will get a warning message showing the system total

and the difference between them. After

the correct total has been entered, select Finish. A Closeout Successful message will appear

and the teller will be closed out.

Deposit Tape Closeout

Enter the amount of each check cashed one by one

pressing the enter key after each check.

When complete, a total dollar amount as well as a total check count will

appear at the bottom of the screen.

Select OK to continue.

A totals summary screen will appear and you are

required to select a destination for the deposit tape to print to. Select Finish to complete the closeout and

print the deposit tape.

Store Closeout (Teller)

If teller closeouts are being done, a store closeout

must be completed after all teller closeouts have been done. Simply select Store Closeout from the

closeout menu. Select Start and wait

for the Store successfully closed message to appear. Select Close after the store has been

closed out.

Store Closeout (Only)

There are also the same two types of store closeouts

as there are teller closeouts: Total

check closeout and Deposit tape closeout.

The store closeouts work in the same manner as the teller

closeouts. The total check closeout is a

one time total check amount entry that will closeout the tellers drawer. The deposit tape closeout is a check by check

amount entry that will closeout the tellers drawer after each individual check

amount has been entered.

Total Check Closeout

Enter the total amount of all checks cashed. If the your total does not match the total

the system calculated, you will get a warning message showing the system total

and the difference between them. After

the correct total has been entered, select Finish. A Closeout Successful message will appear

and the teller will be closed out.

Deposit Tape Closeout

Enter the amount of each check cashed one by one

pressing the enter key after each check.

When complete, a total dollar amount as well as a total check count will

appear at the bottom of the screen.

Select OK to continue.

A totals summary screen will appear and you are

required to select a destination for the deposit tape to print to. Select Finish to complete the closeout and

print the deposit tape.

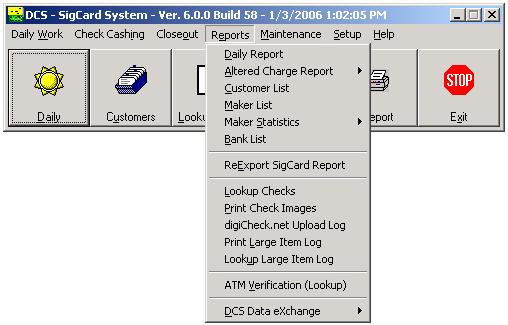

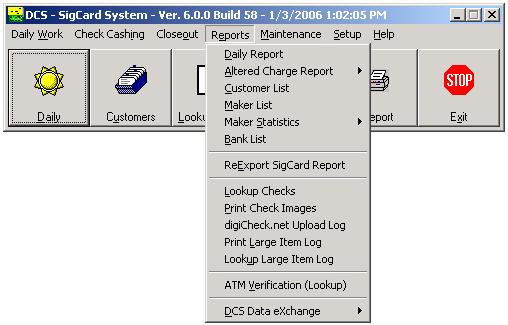

SigCard has the capability of generating various

customer and maker reports.

Daily Report

The Daily Report is a list of the all checks cashed for each maker on the

current day/session. The report can be for specific teller(s) or inclusive of

all tellers.

Altered Charge

Report This report can be printed for the current day/session or for past

dates. The report will list any check cashing transaction where the service fee

was altered.

Customer List

This report can be printed for customers with specific flags, or no flag, that

have had activity within a specified date range.

Maker List

This report can be printed for makers with specific flags, or no flag, that

have had activity within a specified date range.

Maker

Statistics These reports can be printed for makers by specific information.

Specific Date. You can

generate a report of checks cashed on a specific date.

Specific Date of

Week. This report will print all

checks cashed on a specific day of the week within the range of dates you

specified. For example, you can choose to print a report of all checks cashed

on Friday between 06/01/2003 and 09/30/2003.

Date/Range Summary. This option allows you to print a report of

all checks cashed between two date ranges.

Hourly Break Down. This

report will print all check cashing activity for a specific hour within a

selected date range.

Specific Maker. This

report is for a specific maker by activity date range. The report can be in

detail or in summary format.

Bank List This report generates a list of all banks with general

information from the bank record. The list can be sorted alphabetically or by

ABA.

ReExport SigCard Report This report will export check

cashing transaction information into a file named Report01.doc and store it

in the same directory where SigCard is run. There is a setup in Setup/System

Settings//Store Setup for this report to run. The checkbox for Export

Cashed Checks to report.doc file must be checked, if it is not checked, the

menu item for this report will be disabled (grayed). Note the checkbox option

may only be visible by System Administrator.

Lookup Checks This report can be generated by date(s) of store closeout. The report

will list any check that was cashed within the timeframe of the closeout. You

can select specific checks from the list and view more details and/or the

scanned check image. There is an Advanced Search that will use the store

closeout timeframe, and will search by Maker, Customer and/or Check

Information.

Print Checks Images. This report will print images of all

checks scanned into the system for a particular day/session.

Lookup Large Item.

View a report of checks that exceed a specified limit. For more information, follow this link: http://www.dcsorg.com/whats_new/5.4.1.51%20changes.htm#_8.)_Large_item_report.

ATM Verification (Lookup) This

report will display a list of account verification requests and the response.

This report is related to Setup/Real Time ABA Account Verification.

The Maintenance Menu contains options that allow for

bank maintenance, customer/maker file maintenance and other data maintenance.

Bank Maintenance

This option allows you to look up, edit, add, and

delete Banks in SigCard.

Bank Search Screen

The bank search screen search criteria can be entered

in the same way the customer or maker search criteria is entered. In addition, an existing bank can be looked

up simply by scanning a check with that banks ABA through the MICR-reader.

Search Bank

The search results from an ABA of 00 and a bank name

of tes. From this window you can choose Delete, New or OK. If you choose OK

the bank information will display and you can edit the record.

Edit Bank

Bank maintenance screen. This is the record found as a result of the

search criteria entered above. All

fields in the bank record can be maintained from this screen.

Delete Bank

You cannot delete a bank record if it has a

relationship with one or more makers. To delete a bank, simply select Delete

and confirm the bank deletion.

Add

To add a new bank, choose 'New' from the bank search

screen. Because of the importance of the

ABA number in identifying each bank, you will be asked to key in the ABA twice

to prevent errors in entry. To be more

accurate and efficient, simply scan a check from the new bank through the

MICR-reader. It will automatically populate the ABA number.

ABA number This number is

filled in from the entry on the previous screen.

Verify ABA

Only. This option refers to what the

MICR reader will associate with the maker for the ABA/Account number. US

Treasury checks, as well as many state and local government checks, use a

numbering sequence that is different than other makers. The ABA number on these

'special' checks is also the checking account number. The number that would

normally be MICR encoded as the checking account number is, in fact, the check

number. Therefore, when scanning these checks, SigCard can ignore the numbers

that would be associated with a checking account and instead, popup a list of

'special' makers that are listed by ABA only numbers.

Bank name. The name of the bank.

Contact name. A contact name at the bank.

Phone. The area code and phone number of the

bank.

Fax. The area code and phone number of the fax at

the bank.

Address. The street address of the bank.

City. The city the bank resides in.

State. The state the bank resides in.

Zip Code. The bank zip code, which can include an

optional 4-digit extension.

Reset Password

When multiple tellers are using the same computer

and/or when a teller leaves the computer to do other work, this will keep the

SigCard application running, but require the next transaction to be preceded

with a password to access the application. There is a set up option that is

often used when multiple tellers are using the same computer. It is in

Setup/System Settings/Security Setup/Password Setup. The checkbox for Reset

Password after every transaction when checked will require a password before

the next transaction can be entered.

Sax Comm/Ocx Switch

This menu option should only be visible to System

Administrator. It is used for internal testing only.

Export to Main Office

This option will create an XML file of the information

stored in the database. This file can then be imported (see Import to Main

Office) into the Main Office. There are three types of records including images

that can be exported.

Banks

Customers

Makers

Import from Main Office

This option will create database records from an XML

file (see Export to Main Office) of information from the Main Office to be

stored in an alternate database. There are three types of records including

images that can be imported.

Banks

Customers

Makers

Export to Another Store

This option will create an XML file of the information

stored in the database at one store, then, imported (see Import to Another

Store) into another store. There are three types of records including images

that can be exported.

Banks

Customers

Makers

Import from Another Store

This option will create database records from an XML

file (see Export from Another Store) of information from an alternate database.

There are three types of records including images that can be imported.

Banks

Customers

Makers

Import Data From DOS

For DCS use only, options include:

All Info (with or without

images)

Only images

Purge History

SigCard allows you to purge database records. These

records will be deleted and archived. They can be retrieved and restored to the

database. The archived file(s) will be stored in the directory designated in

Setup/System Settings/Store Setup History Purge/Restore File Path. During the

purge process several files will be created in this directory, the final file

will be stored as a zip file and any related archive files will be deleted.

There is also a SigCardPurge.log file created in this directory.

There are three

types of records including images that can be purged.

Customer

Maker

Transaction

For Customer and Maker records, you can purge a single

record, merge two records into one, or you can purge multiple records based on

last transaction date.

Purge Customer / Maker Records

The customer/maker purge menu offers three options.

Single

Customer/Maker This option allows

you to select and purge a single customer/maker record. After selecting the customer/maker, you will

be asked to confirm the deletion.

Duplicate

Customer/Maker This option allows

you to merge the information for two identical customers/makers. Select customer/maker you want to delete (all

information and transactions will be moved into the second customer/maker).

Next, select the customer/maker you want to move the transaction information

into, adding the information to the existing record. Select Delete and confirm the

deletion. The information and

transactions will now be contained in the second record. If any images,

signatures and/or IDs were in the source file, but not in the target file,

those images will be merged into the target file. Employer and physical descriptions

(height, hair, etc) will not be merged. If the source file has a flag and the

target does not, the flag will not be merged into the target.

Inactive

Customer/Maker. After using SigCard

for a considerable time period, you will probably want to purge inactive

customers/makers. The system allows you to delete customers/makers and/or their

transaction records if no activity is found subsequent to the date you are

asked to input. For example, if you

input 01/01/2000 and the current date is 08/08/2003, the system will delete

all customers/makers who have not had any activity since 01/01/2000.

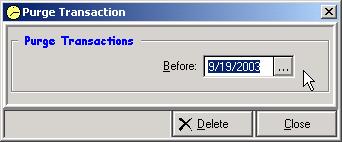

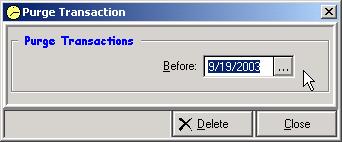

Purge Transactions

Select a date to delete all SigCard transactions prior

to date selected.

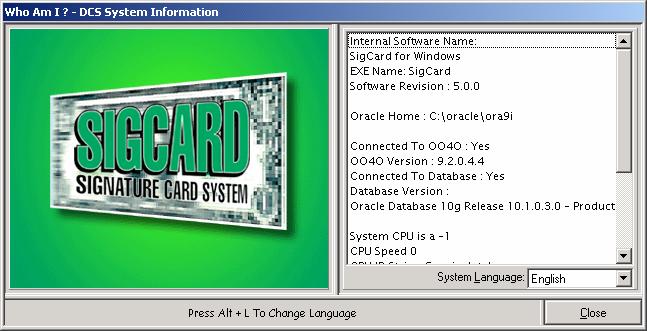

The SigCard

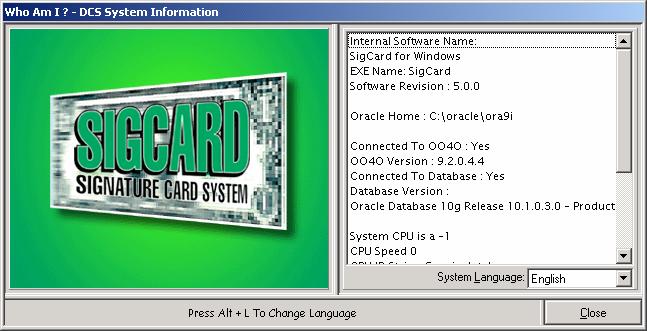

Help Menu allows you to access general software information, detailed

version/connectivity/user information, and the SigCard help documentation.

About

Software

Provides

SigCard version, Database connectivity,

CPU, and current user session information.

SigCard

Help (on the Web)

Provides access to the most

current SigCard documentation via the Help Menu.

About

DCS

Provides

basic SigCard copyright information.