Digital Currency Systems

Bill Payment System Documentation

Version 7.4.3 build 143

Bill Payment System – User Guide

Bill Payment System is the module used for

processing customer utility payments, loading prepaid Visa cards, and selling

cell phone cards and PINs. Nearly 4,000

companies are available from a nationwide list of billers (including most major

utilities), and payments are processed through the DCS partner company,

Firstech. Using the newest technologies,

expedited payments are now available (for select billers) with the company

notified of payment within an hour.

The following documentation describes the

process of setting up and using the Bill Payment System. Much of the setup process will be done for

you by DCS personnel during the training phase.

Should you have questions regarding BPS that are

not covered below, please do not hesitate to call DCS at 847.498.9955.

In this document

↓ Logging in

for the First Time

↓ Choosing a Closeout Procedure

Setting up Your Menu

↓ Importing Company and Product Lists

Hardware Setup

Keying in Payments

↓ Navigating the Daily Work Screen

Special Products

End of Day Activities

Reports

↓ Viewing, Printing, and Saving Reports

Getting Started

Logging in

for the First Time

Double click on the BPS

icon (which should be found on desktop).

Log in using the initial

password, “vault.”

Upon logging in for the

first time, the available menu options are limited. This is because valid users must be created

in order to have full access to the buttons and menu items. Creating a new user is described in the

following section.

Password/User Setup

All DCS systems share the same set of usernames and

passwords. If you are getting started

with your first DCS product, setting up a user (or set of users) is the first

step.

NOTE: Only certain passwords have access to this section,

including the “Vault” password used for first-time login.

Click on the Setup

menu, then on System Settings, Security

Setup and choose User Setup.

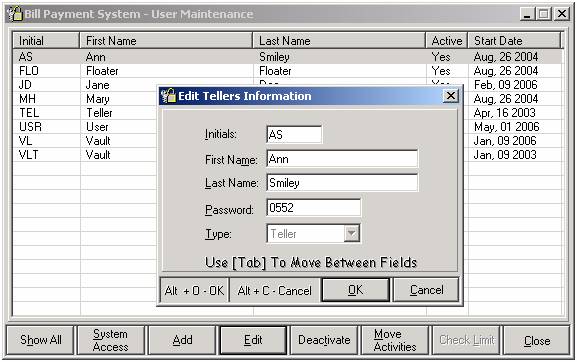

Add a New User

Click the Add

button. A window pops up (as seen above)

where a name and password can be keyed in.

The password can be numbers or letters and is not case sensitive. It is this password that will be used to log

in when the application is opened.

Edit an Existing User

Change the information for the highlighted user by clicking the Edit button. The same box comes up that is used to add a

new user, but it has the user’s information already filled in. Edit the necessary fields and click OK to save changes.

Active and Deactive Users

The list of users initially displayed includes only active users. Active users can log into the system and

perform transactions. By clicking Show All, all users are

displayed in the list, whether they are active or not. To deactivate a given user, highlight the

corresponding row and click Deactivate.

This user’s password is then no longer valid.

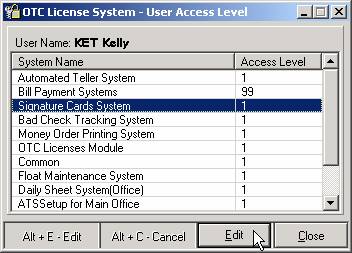

System Access

While some features must be made available to all users, others

should only be accessible to managers and owners. Each user is assigned a system access level

between 1 and 99. 1 is the lowest level

and should be assigned to those employees who only need access to the most

basic features. 99, on the other hand, should

be reserved for owners and managers.

Highlight a row and click the System

Access button.

Because a single set of usernames and passwords is shared

throughout all DCS systems, a list of all available DCS modules is displayed

here. The access level for a given user

can be set differently for each of the DCS modules you are using.

The default access level is set to 1 for all systems. As described above, 1 is the lowest security

level and 99 the highest. The access

level required to perform certain actions is set in the security module. See the Module Setup section for more details.

Edit— Click the edit button to change the access level. Key-in a value between 1 and 99.

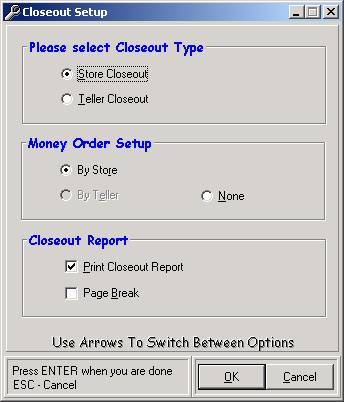

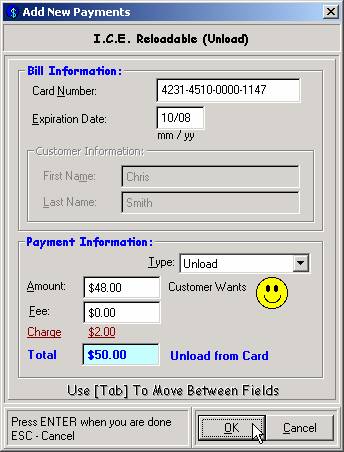

Choosing a Closeout Procedure

At the end of each day, after all the bill payments have been

keyed in, one of the last things to do is Closeout.

This is simply the process of adding up the stack of bills (company by

company) and verifying that your totals match the ones in the computer.

Before beginning to process transactions, it is a good idea to

come up with a closeout procedure. The

two options in BPS for you to choose from are Store Closeout and Teller

Closeout, and whether users balance separately is the key factor in

determining which one to go with.

Click on the Setup menu and then System Settings, Closeout Type

Setup.

Store Closeout

Some locations have one computer for bill payments, and all bills

are kept in a single pile regardless of which user keyed in the

transaction. Often times with this type

of setup it is unnecessary for each user to have their own login, and everyone

shares a password. If this sounds like

your location, it would be best to go with the Store Closeout option.

By choosing Store

Closeout, all bills are closed out when the Closeout button is pressed, regardless of who

entered what bills.

Teller Closeout

If each teller balances separately at your store, choose Teller Closeout. With this option, each user must keep their

bill stubs separate throughout the day.

Each user must also have his or her own login so that BPS can keep track

of who entered what bills. At the end of

the shift, each teller closes out their own bills when they click the Closeout button.

Money Order Setup

Money orders are typically paid directly to the utility, or to a

bank account that is ACH’d. For record

keeping purposes, some stores find it useful to keep the money order numbers

associated with each day’s payments.

This can be done through BPS at the time of closeout. The system prompts the user for the money

order number after the payment total is verified.

If a single money order is made out for each utility, choose the

By Store option. If tellers are balancing separately and

printing money orders separately for their own bill stubs, choose By Teller. To turn this option off, choose None.

Closeout Report

For a report to print out automatically at closeout, check this

box. This report includes a list of the

day’s payments grouped together by company.

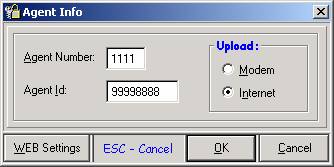

Connecting to Firstech

One of the key features with BPS is the ability to upload

bills. “Uploading” refers to sending a

file over the internet that has company, account, and payment information. With BPS, this file is sent to a company

called Firstech, who in turn process the payments. While BPS could be used for purely record

keeping purposes, it is uploading that makes keying in payments

worthwhile.

In order to upload, a valid account with Firstech must be

established. At that time, they will

provide an Agent Number and Agent ID. These two numbers are used to identify your

location as payments are processed and uploaded.

Click on the Setup

menu and then choose System Settings,

Firstech Agent Info.

Key-in the Agent Number and ID.

On the right, choose Internet. Modem connections are no longer

accepted. An internet connection is

required to connect to Firstech.

Click OK to

save changes.

Cardserver

POS

Cardserver is a DCS

application that works hand-in-hand with BPS.

While this is not required to use the most basic features, there are

several other products (gift cards and cell cards) and special services

(instant payments) that can also be offered through BPS. Having Cardserver properly installed gives

you access to these products and services.

Installing Cardserver

If you are installing the

DCS applications for the first time, you will come across a screen in the

installation process where you choose which elements to include. Cardserver should be installed on one (and

only one) computer. This does not mean

that only one computer will have access to the special features Cardserver

provides. Through the network all

computers running BPS will be able to communicate with Cardserver, therefore

providing the additional products and services.

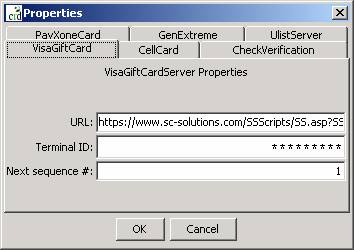

Configuring Cardserver

Moments after installing

it, Cardserver opens automatically and should be seen in the system tray. Click once on the “crd” item with your mouse.

NOTE: If you do not see

it in the system tray after a minute or so, double click the CRD icon on your

desktop.

![]()

The Cardserver

application will open in the center of the screen. The various services are configured by

clicking on File, Properties.

Each tab in the

Properties window corresponds to one of the various services offered through

BPS (except for CheckVerification which is a Sigcard add-on). Whenever a new service is activated, the

third party generates a pin or ID that must be registered here. DCS personnel will typically do this for you,

and this screen should not be tampered with if you are unfamiliar with the

fields.

NOTE: Instant Payments

require Cardserver to be properly installed on a single computer. No additional settings are required.

Setting up Your Menu

Importing Company and Product Lists

There are several third

party companies that DCS has partnered with.

As described in the preceding sections, these companies provide services

that integrate with BPS. Three of these

companies and the services they offer are as follows:

Firstech – Upload bills

Coinstar – Cell Cards and PINS

GenExtreme

– I.C.E. Gift and Reloadable

Cards

Once accounts have been

activated and unique IDs (or pins) have been keyed-in, there is one final step

for each of the various services. That

step is importing the list of products.

It is through importing these lists that the menu is populated.

Each of the import

options is accessed from the Maintenance

menu.

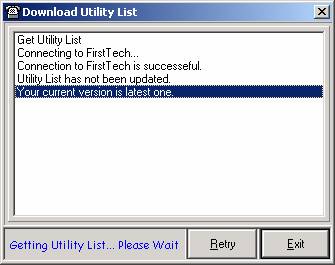

(Firstech) Import Utility List

The Utility List includes all companies that Firstech is currently

processing payments for. Along with the

company names, it contains account number formats, check digit routines, first

and last name requirements, and payment type (instant vs. regular). Generally speaking, this list contains all

the settings required to process bill payments and successfully upload them to

Firstech.

Through a joint effort

with DCS and Firstech, this list is kept up-to-date on a regular basis. Should a certain company change their account

number format, BPS downloads and imports the Ulist automatically, replacing old

settings with new ones— your system is kept current with no effort on your

part!

To initially populate the

company list (for first time BPS users) the Ulist must be imported

manually. To do this, go to the Maintenance Menu and choose Download Utility List.

NOTE: The option below

Download is Import Utility List. The difference between the two is that the

first downloads the file from Firstech and places the list in a directory on your

computer. The second takes the file on

your computer and imports it into the BPS menu.

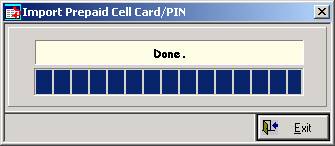

(Coinstar) Import Prepaid Products

Coinstar offers a large

assortment of Cell Cards and PINs that can be sold directly through your BPS

menu. If you would like to offer these

products, we will provide you a Merchant ID and Device ID and key them into POS Cardserver. Then, from the Maintenance menu is the Import

Prepaid Products option. Clicking

here downloads and imports the Prepaid

Products List, which populates your menu with Coinstar products.

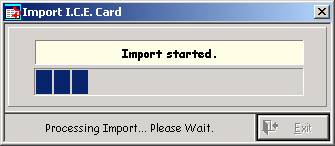

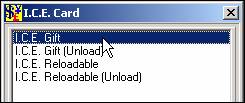

(GenExtreme) Import I.C.E. Cards

Another product that can

be sold directly through your BPS menu is the Prepaid Visa I.C.E. card. There are two different types of I.C.E. cards—

the Gift and the Reloadable. The Gift can be loaded once, while the

Reloadable (as the name implies) can be loaded any number of times. For more information on these cards and how

to process the transactions, click here.

Setting up BPS to sell

these cards is easy. The first step is

registering a PIN in Cardserver

(under the GenExtreme tab of the properties screen), and the second is

importing the items into your menu. The

second step is done from the Maintenance

menu by clicking Import I.C.E. Cards.

NOTE: DCS will typically

do the setup portion of this for you.

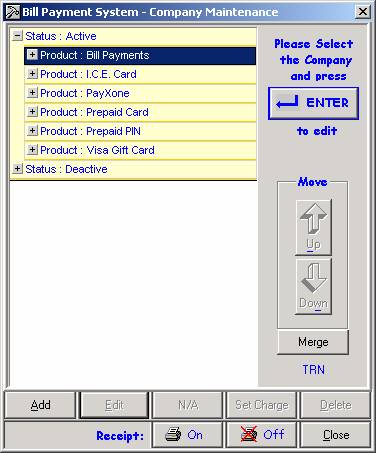

Managing your Company List

The previous section described how to populate your BPS

menu. This was done by keying in IDs (or

PINs) to identify your location, and then importing product lists. Once this has been completed, it may be

necessary to deactivate some transactions or put them in a different order.

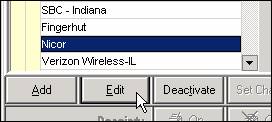

Click on the Company

Setup button.

Navigating the Company Setup screen

Each submenu (denoted by the yellow bar) can be expanded or

collapsed by clicking the plus or minus symbol.

So, for example, if you wanted to change the order of products offered

in the Bill Payments menu, you would click the “+” symbol next to Product: Bill Payments.

Deactivating Menu Items

When populating your menu for the first time, all products and

services initially come in as active. An active item means that it is currently

offered at your location and therefore gets a spot on your BPS menu. Deactive

items, on the other hand, are not available from the menu. Unused products are often deactivated (instead

of deleted) in case they will be offered again in the future. Highlight any items that you do not want in

your menu and click the Deactivate

button.

Rearranging Menu Items

On the right side of the screen is a box that says Move with up and down arrows. To rearrange menu items, highlight each one

and use these arrows to move them into the desired order.

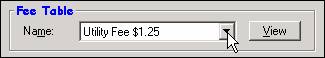

Changing the Fee

Fees are assigned through the Company Setup screen as well. Before assigning a fee, however, the fee table must be created. This is described in detail in the following

section, Creating

Fee Tables. Once it has been

created, assigning the fee is described in the Assigning Fee Tables section.

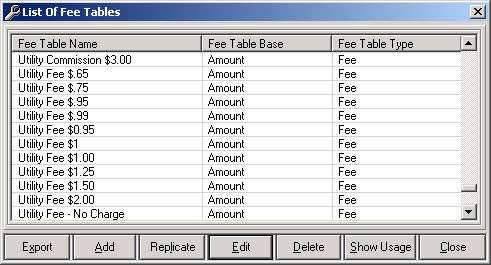

Creating

Fee Tables

Create and maintain fees for customer transactions.

NOTE: DCS Systems share fee tables, so making changes to fees

here can affect separate modules.

Any fee used by DCS software will be listed in this table. Existing fee tables can be adjusted by

highlighting them and clicking Edit.

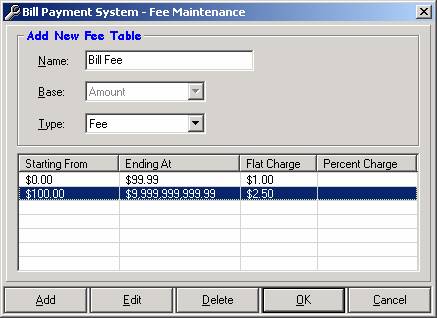

Add New Fee Table

Click Add to

create a new fee table.

Initially, the rows in the fee table will be blank. In the example above, two rows have already

been created, indicating that an amount from $0.00 to $99.99 will result in a

$1.00 fee, and anything from $100.00 and over is

$2.50.

Setting up a fee like this would consist of three basic steps,

described here.

Step 1

Give the fee a name by typing it in the Name field.

Step 2

Click Add.

In the

NOTE: The

Click OK or

press Enter.

The first entry is now listed in the fee table.

Step 3

Click Add

again.

Now type 100 in the From field and 2.50 as the Charge. Click OK.

Click OK to

save changes or Cancel to exit

without saving.

Assigning Fee Tables

Once the fee tables have been created, they can be assigned to

any of the items in your BPS menu.

The Company Setup screen is described in detail

above. This is the screen (accessed by

clicking the Company Setup button) where you can access the fee-assignment

section. This section is somewhat

hidden, but can be found fairly easy by remembering the “3 Edit” rule.

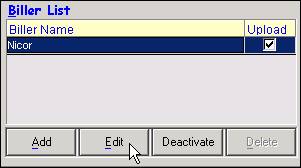

First, highlight the company or product and click Edit.

At the bottom left corner of the screen is the Biller List

section. Click Edit from there.

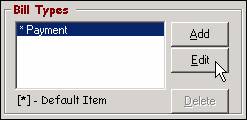

Finally, choose from the bill types— for Instant Payment

items, a different fee can be assigned based on payment method.

Click Edit.

We finally arrive at the screen where the fee can be

assigned. Use the dropdown menu to

choose the fee table you created in the previous section.

Hardware

Setup

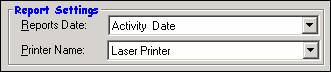

Report Printer

A variety of reports are available through BPS, described in the

Reports section

below. Any report can be displayed on

the screen (by using the Preview option), but having a hard copy is often

useful. To do this, a printer must be

selected in the Store Setup screen

(under the Setup menu -> System Settings).

Reports Date

Because stores have different policies and different times of

closeout, DCS has come up with a few options for determining which records are

displayed for a given date. While some

locations want to use the date the transactions were processed, others are more

concerned with the session (sessions are defined from one closeout to the

next).

Use the Activity Date option to use the actual

date the transactions were processed, regardless of when the store was

closed. Start Session Date will tie all records to the date the session

began. Similarly, End Session Date ties records to the date they were closed out.

Printer Name

Choose the printer used to print reports from the drop down

list. Any printer installed in Windows

shows up in this list.

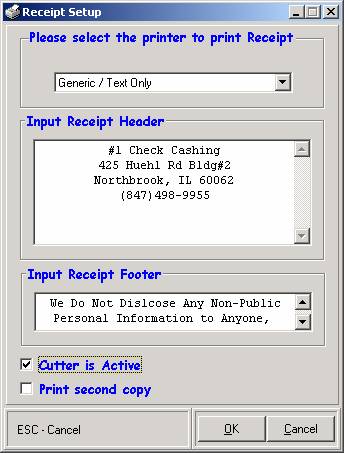

Receipt Printer

Setup a receipt printer along with the header and footer.

Click on the Setup

menu, and choose Hardware Setup, Receipt Setup.

Choose the printer used to print receipts from the drop down list

at the top of the screen. Any printer

installed in Windows shows up in this list.

Input Receipt Header/Footer

The receipt Header

and Footer can be edited from this

window. Text entered here is printed at

the top and bottom of each receipt.

Cutter is Active & Print second copy

Cutter is Active— Check this box for a spliced receipt.

Print Second Copy— Check here to print a second copy of each receipt. This can also be done manually by clicking on

Reprint Last Receipt after

completing a transaction.

Keying in

Payments

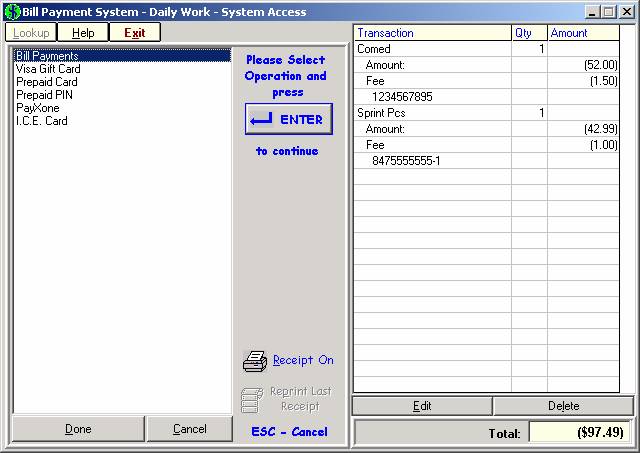

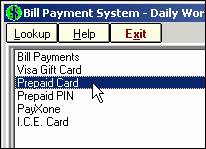

Navigating the Daily Work Screen

The Daily Work screen is used for the day-to-day processing of BPS

transactions. It is from here that

payments are keyed in, prepaid cards are loaded, and cell phone products are

sold. Click on the Daily button from the main menu to access the Daily Work screen.

In this section, you will find information on processing a basic

transaction— namely, paying a bill.

Detailed information is available in later sections on products such as Cell Cards and PINs

and I.C.E. Cards.

Left Side of Screen – Menus and Submenus

In recent versions of BPS, all services were accessed from a

single list on the main menu. This was

not an issue at the time because the list was 20 companies or less. As more and more products and services were made

available through Bill Payment System, it became necessary to group together

similar types of transactions into submenus.

This made finding the desired item easier and speeds up transaction

time.

The current structure of the main menu can be seen in the

screenshot above. Based on the services

you decided to offer, your main menu may look identical to this or contain a

subset of this list.

Double click on the top

item, Bill Payments. Then, choose any utility company from the

list.

Account Number and Check Digit

Different fields (Account Number, First Name, Last

Name) are required for different companies.

These types of requirements are automatically set when the Utility

List is imported. Every

company, however, has the Account Number field.

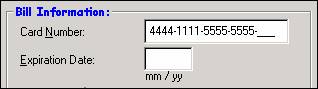

![]()

The account number has both format and length— we call this the mask.

Typically the entire length of the mask will be populated when a valid

account number is keyed in, but there are some types of bills where the length

will vary.

One of the digits (typically the last digit) is used to verify

that the account number is valid. This

digit is called the check digit. Companies use different formulas and

algorithms to generate the check digit, but it is simply used to help prevent

mistakes such as typos. Some companies

do not include a check digit routine in their account number. If this is the case, the user is typically

required to key-in the account number twice.

Key in the account number and name fields as they are printed on

the bill, then enter the amount. The fee

will fill in automatically based on company settings, but can be changed at the

time of transaction.

Right Side of Screen – The Transaction Workspace

Once you click OK,

the payment will show up on the right side of the screen (where Comed and

Sprint are in the example above). This

portion of the screen can be thought of as the transaction workspace. If you are printing receipts through BPS,

transactions listed in this area will all be included on a single receipt. Highlight one of the listed payments by

clicking on it with the mouse, then click Edit

to return to the payment entry screen, or Delete

to remove it completely.

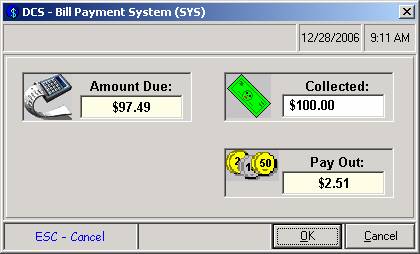

Complete the Transaction

Once the payment has been entered correctly and you are ready to

complete the customer’s transaction, click the Done button.

The Amount Due is

displayed on the left with a calculator on the right. Key-in the amount collected and press Enter to

calculate the pay out.

Instant Payments

Some bills can now be processed within an hour of payment (currently

this is only for Comed, but the list will grow in the future). This means that preliminary credit is given

the customer according to real-time communication between BPS and Firstech. As with most payment systems, actual payment

occurs in a batch process at a later time.

This batch process is still dependent on the end-of-day uploads

which are normally accomplished by BPS users.

Should this upload not be accomplished timely, the customer’s Instant

Payment will be cancelled.

To take advantage of the new service, POS Card Server must be running on one (and

only one) computer. Otherwise, you will

receive an error which states: Failed to

connect to Card Java Server: (127.0.0.1).

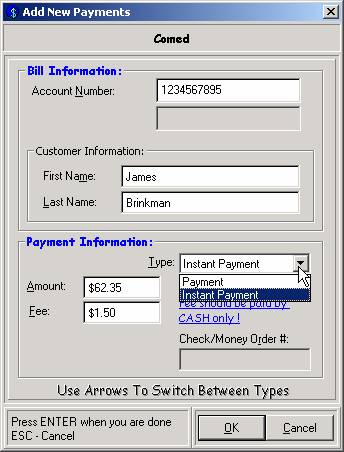

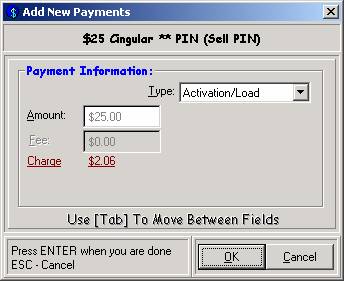

Payment Information

The Type of

upload can be changed at the time of the transaction by choosing from the

dropdown menu. The default for this

setting is Instant Payment, so if the setting is left as it is the payment will

be sent instantly (with details of the payment printed on the receipt). The Fee

defaults to $1.50 for these payments.

To change to the older method at the time of the transaction,

click on the down arrow and choose Payment. When this setting is used, the fee changes to

the lower amount that was set before instant payments were available.

The Check/Money Order #

field is grayed out for Instant Payments.

This is because personal checks are not guaranteed under this

program. Taking such items would be at

your own risk.

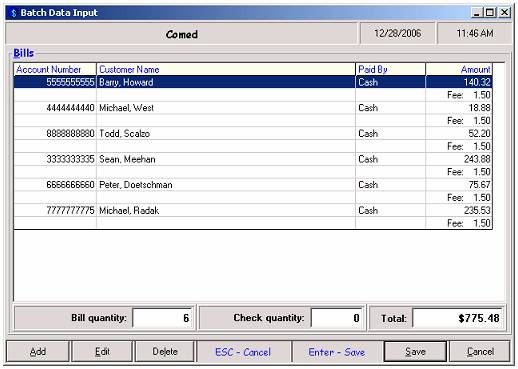

Batch Entry Mode (first make sure its checked in

company setup)

Stores that do not print a receipt through BPS may prefer to key-in

all payments at once, instead of at the time of the transaction. The process of entering large quantities of

bills at once is called batch entry.

While groups of bills can be processed from the Daily

Work screen, it is easier to use batch entry if you are doing a

large number at once. To do this, choose

the Batch Data Input option from the

Daily Work menu.

Initially, a list of all billers is displayed for you to choose

from. This is because batch entry is

done on a per-company basis. So, before

beginning, divide up your bills by type.

Then, one company at a time, key-in those payments.

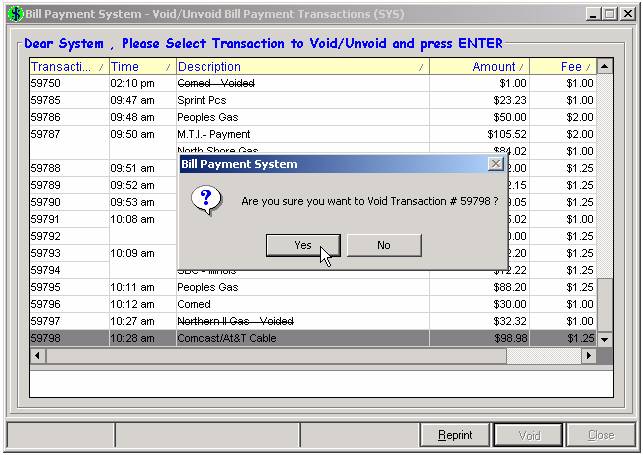

Voiding Transactions

Sometimes mistakes are realized after the transaction has been

completed. To void (or unvoid) a

transaction, click on the Daily Work

menu and choose Void Transaction.

NOTE: Once a session is closed, all transactions are final and

cannot be voided.

A list of all unclosed transactions appears on the screen. A transaction with a line through the

description is already voided.

Highlight the desired transaction and click the Void button. A window pops up asking if you are sure you

want to void this transaction. Click Yes to void.

Similarly, a transaction can be un-voided. Highlight a voided transaction and the Void button will switch to UnVoid. Click on UnVoid and a window pops up asking if you are sure you want to

unvoid this transaction. Click Yes to unvoid.

Special

Products

Cell Cards

and PINs

Through a partnership

with Coinstar, cell card products are available to sell directly through the

BPS menu. There are two different types

of these products: Cards and PINs.

A card is a physical phone card that is handed out the window, whereas a

PIN is a long string of numbers that prints on the receipt. There is a greater variety of PINs, mostly because

they do not require the store to keep inventory in order to sell them.

All BPS customers have

the option to offer these products.

Posters with the rates displayed, initial cards stock, a spindle for the

cards, and a booklet of different rates is included in the installation

package. Setting up the software is

simple once your Coinstar account is activated.

It involves keying IDs into the POS Cardserver and importing

the product list, both of which are done for you by DCS.

There is no charge for

the initial stock of cards (as they have no value until loaded through

BPS). Payments due to Coinstar are made after the sale. More information on payments and what is owed

is described later in this section— see Calculating

the Payment Amount.

Commission and Sales Tax

A fee is not added on to

the amount of the Card or PIN— instead, the store keeps a commission for each

sale. Commission rates are different

based on the product. You can see each

of these rates from the Company Setup screen. To find the total commission collected for a

given session, select the Prepaid Cards and PINs from the System Reports

screen.

Some states require sales

tax to be collected for these types of products. DCS personnel will set this up for you so

that the tax is calculated and added on appropriately.

Requirements to offer these products through BPS:

|

System Requirements |

|

An internet connection.

BPS activates these products in real time, when the transaction takes

place. It does this by connecting over

the internet to what is called a processor.

|

|

The POS

Cardserver installed and running on one (and only one) computer. |

|

The Prepaid Card

and Prepaid PIN menu items. See Importing

Company and Product Lists. |

|

For the Cards, a magnetic card-reader is needed in order to

activate the card. Typically, Coinstar

will provide one card-reader free of charge.

Additional readers can be purchased from DCS. |

|

For

the PINs, a receipt printer is required.

|

Loading the Card

Double click on the Prepaid Card menu item. A submenu of the various cards is displayed

(divided up by type and dollar amount).

All of the cell cards in your inventory are initially blank—that is, they

start with no value. These blank cards

can then be loaded with any value (ranging from 5 to 50 dollars).

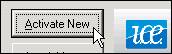

Double click on the item

that corresponds to the correct card type and dollar amount. A screen is displayed with the option to

activate or deactivate the card. Click

the Activate New button.

Using the magnetic

card-reader, swipe the blank card. The Card Number field will populate

upon a successful read.

NOTE: The last few digits

will usually not populate in the Card Number field. Do not be alarmed! This does not mean the card was incorrectly

read. Also, the expiration date will not

populate. This field is not required.

Click OK and complete the transaction

in the usual way (described above).

A log is displayed as BPS connects (through the internet) to

instantaneously load the card. The final

message will read Card Successfully

Loaded.

Loading the PIN

No inventory is needed to

sell a PIN. An active PIN number is generated

and prints onto the receipt (along with the phone number for activating it).

Double click on the Prepaid PIN menu item. This brings up a list of the various PINs

available for sale. Because of the great

variety offered through Coinstar, the list is long and it may take a lot of

scrolling to find the desired item.

However, a Search

field at the bottom of the screen allows you to search for the product by

name. Typing a letter or two in this

field will narrow down the list to only those products matching your criteria.

Simply click OK on this screen. There is nothing to fill out here, just

verify that the PIN type and amount are correct. Complete the transaction in the usual manner

(described above).

As with the cards, BPS

must connect through the internet to generate the PIN. If successful, the PIN will be displayed on

the screen and printed on the receipt.

The phone number to activate the service is also printed on the receipt.

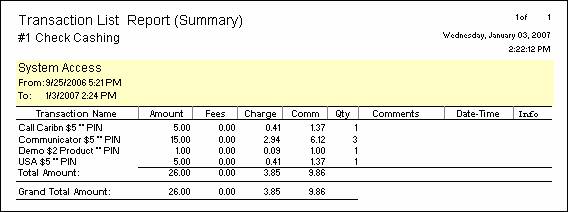

Calculating the Payment Amount

At the end of each

session, a money order must be made out for the day’s sales. This is calculated by taking the total amount

of all cards and PINs and subtracting the commission. To calculate this, it is necessary to bring

up a transaction report.

From the Reports menu, choose the System Report option.

On the left side of the

screen, select only those boxes next to Prepaid

Card and Prepaid PIN. The session date and the selected tellers can

be left to their default setting. Click Print.

The report generates a

list of all the products sold throughout the day. At the bottom of the report is the Grand Total Amount. By taking the Amount and adding the Charge

(sales tax), you will get the total amount collected for all Coinstar

products. Because the store keeps the

commission, the Comm column must be

subtracted from this total.

Therefore, when making

out the money order, use this formula:

Amount + Charge – Comm =

Payment

In the example above,

this would come out to

$26.00 + $3.85 – $9.86 =

$19.99

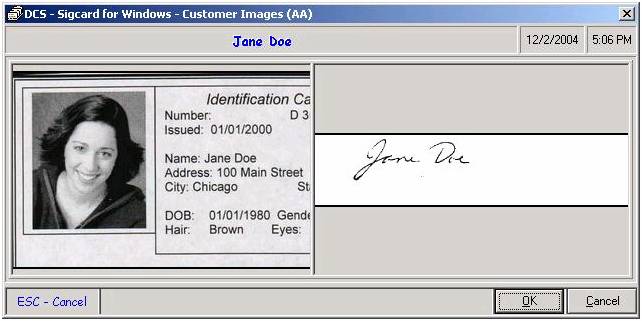

I.C.E. Cards

ICE Gift ICE

Reloadable

There are two types of

ICE cards. The Gift Card can be loaded

once and cannot be reloaded. The ICE

Reloadable card can be reloaded any number of times. A different design on the face of the card

can be used to distinguish a Gift card from a Reloadable, as you can see

above.

Requirements

|

System Requirements |

|

An internet connection. |

|

A Card Reader (required at each terminal where you’d like to

process ICE transactions) |

|

A receipt printer (also required at each terminal for the

authorization printout on the unloads) |

|

An ID scanner… |

|

The physical ICE Cards (both Gift and Reloadable) |

|

POS Cardserver installed on one and only one computer. |

|

GenExtreme PIN# |

The ICE Menu Items

Once the product

list is imported, the I.C.E. Cards are available alongside the other

familiar BPS menu items.

Double click on the I.C.E. Card item on the main menu. The following submenu comes up.

Separate transactions are

used for the two distinct types of cards.

You cannot load a Gift card, for example, under the Reloadable transaction. So,

first determine what type of card you are dealing with.

To load a Gift Card,

choose the I.C.E. Gift option. This same option is used to do a Get Balance on a card. The second option, I.C.E. Gift (Unload), is used to decrease the value of a customer’s

card (and return them cash).

The same logic applies to

the menu items for the Reloadable Card.

Choose the I.C.E. Reloadable

for the initial sale of a Reloadable Card, to load additional funds, or to get

a balance. Then the I.C.E. Reloadable (Unload) is used to take cash off of a loaded

card.

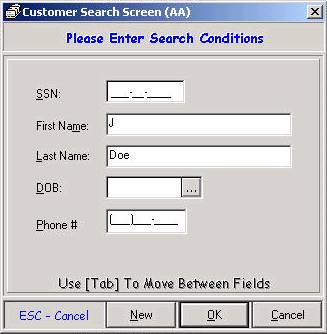

Searching for existing customers, or adding as new

If you are also using the

Sigcard program (the DCS check-cashing software), you are accustomed to

managing records. The same functionality

for looking-up and adding new customers in Sigcard is also in place for certain

ICE transactions. While some ICE transactions

do not require keeping a customer record, others have this built into the

process. The three instances with

customer lookup built-in are: unloading a Gift, unloading a Reloadable, and the

initial sale of a Reloadable.

The reason it is required

for unloads is to protect the store from fraudulent claims. An example of this would be if a cardholder

visited your location, unloaded funds, and then claimed that they were never

there. So, for any unloads, the customer

record is kept.

There is a different

reason this is necessary when selling a Reloadable Card. These cards are meant for long-term use, and

the information in this case is to protect the customer. With a permanent card, billing information

can be verified with the customer’s information. Furthermore, lost or stolen cards can be

canceled and the funds can be retrieved (more information in the service

agreement).

As with other DCS

applications, the user is led to gather the required info through a sequence of

screens. When a customer record is

required for an ICE transaction, the following screen will automatically pop

up.

The figure above is the

customer search screen. Sigcard users

will recognize this screen immediately as it is an integral part of the check

cashing process. Find the desired customer

by keying in a few letters of the first and last name. If the customer is not found, they must be

added as new. (If you are not familiar

with the customer search screen, see the Sigcard documentation for more

information.)

Click the New button to add a new customer

record. Customer name and address is

gathered, as is the signature (which is scanned in using the TravelScan).

The signature is an

important aspect of ICE transactions (more on this below). See the Sigcard documentation for details on adding

new customers and scanning signatures.

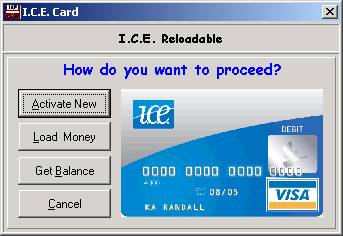

Loading a card for the first time

Choose ICE Gift or ICE

Reloadable based on card type.

Click the Activate New button.

For the Gift Card, this

brings you directly into the activation screen.

For Reloadable, there are

a few more steps. As described in the

previous section, the first window in the sequence is the customer search

screen. Social Security number is

required as it will be used to verify the customer’s identity through

digiCheck.net. Having the correct

address is also essential. While a

temporary card is handed out the window at the time of purchase, the official card will be mailed to the

customer. The card is sent to the

address stored in the DCS system. In the

mailing packet (along with the new card) is the service agreement plus a

schedule of different fees and limits.

Once the customer’s

identity has been recorded, the card-activation screen is displayed.

Key-in the card number

and expiration date; or, you can swipe it through the magnetic card-reader and

these fields will automatically populate.

Next, enter the amount that the customer would like to load.

Enter the amount and

click OK.

Get Balance

Choose ICE Gift or ICE

Reloadable based on card type. Click the

Get Balance button.

Key-in the Card Number or

swipe the card through the card reader, then click

OK. The card balance is displayed on the

screen

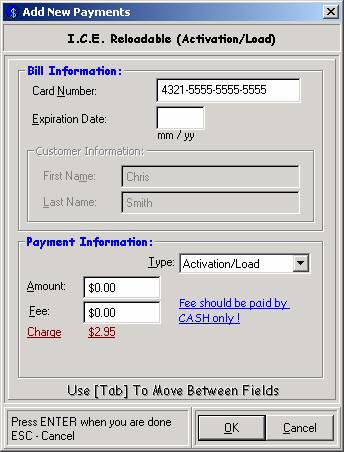

Unloading

Before unloading an ICE

card, it is good practice to get the balance first. This will avoid confusion when the customer

is unaware of the true amount on their card.

To unload funds, choose ICE Gift or ICE Reloadable based on card type.

Click the Unload button. The Customer Search screen appears first,

forcing the teller to identify the customer first.

Swipe the card through

the card reader. The card number will

populate in its designated field. Key-in

the expiration date.

NOTE: You cannot type the

Card Number in using the keyboard. A

card reader is required for all ICE unloads to ensure the card is present at

the time of transaction.

Next, key-in the

Amount. This refers to the amount of

cash the customer wants to walk out the door with. The amount that will actually be unloaded

includes a service fee. In the example

above, the customer asks for $50.00 to be unloaded. The teller keys $48 into the amount field,

and $50 is unloaded from the card. The

Total field at the bottom of the screen displays the actual amount debited.

Your receipt printer will

then print out an authorization for your customer to sign. THIS DOES NOT MEAN THE TRANSACTION IS

COMPLETE. You must have the customer

sign, and you need to store the authorization should the customer contest the

transaction in the future by denying they were present. You also now have the opportunity to compare

the signature with what is stored in the system, as it will be displayed on the

screen. If you do not maintain this

signed authorization, you should expect to lose whatever is contested.

Reloading the Reloadable

From the I.C.E. Card

menu, double click on the I.C.E.

Reloadable option.

Click the Load Money button.

Key-in the Card Number or

swipe the card through the card reader.

Then, enter the amount and click OK.

PayXone

PayXone offers Visa,

Mastercard, and closed loop products in its network. These products can be reloaded directly from

your BPS menu. Examples of PayXone

products are Wired Plastic, Diamond Financial, Heritage Card, and Metro PCS.

Click the following link

for more information on PayXone products:

http://www.dcsorg.com/development/PayXone.pdf

End of Day Activities

Closing Out

BPS has a close-out

feature for verifying payments. It is

good practice to do this on a nightly basis so that mistakes such as duplicate entry or amount mismatches can be caught early. Also, only bills that have been closed out

will be uploaded to Firstech and processed; so for processing to occur in a

timely manner it is necessary to close out at the end-of-day.

To close out, click on

the Closeout button on the

main menu.

A list of all bill types

you have taken throughout the day will appear on the screen. By default they will all be highlighted,

indicating they are selected for close-out.

Press Enter to continue.

The system will ask the

total for each bill type (as seen in the figure above). If the amount entered does not match the

calculated total for that bill, a warning is displayed with the calculated

amount and the difference. Should there

be any discrepancies, the closeout can be canceled at any time (by clicking the

Cancel button). Mistakes can be fixed by voiding the transaction in error or keying-in payments that were accidentally left

out.

Once all totals have been

successfully verified, the Closeout is complete.

NOTE: Bills are not uploaded and processed during

the closeout procedure. Further steps

are required, described in the following section.

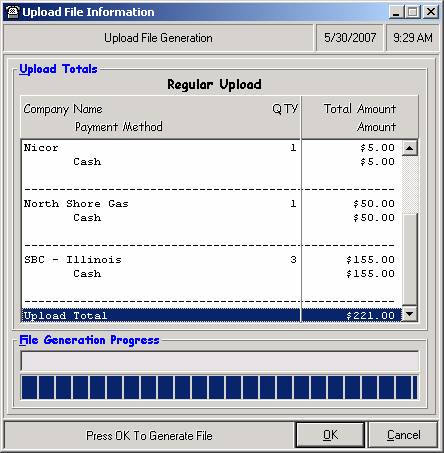

Upload to Firstech

Uploading refers to transferring a

file from your desktop computer to a web server. With the Bill Payment System, a file is

generated that contains account information, payment amounts, and a unique ID

that identifies your location. That file

is then sent over the internet, or uploaded, to Firstech. Firstech then processes the payments based on

what is in this file.

An internet connection

must be established before uploading.

High speed internet (such as DSL) will typically have an ongoing

connection, but dial-up users will need to dial out before uploading.

To upload your payments

to Firstech, click the Upload

button on the main menu.

NOTE: Store Closeout must be completed before

uploading. Only those bills that have

been closed out will be included in the upload.

When the blue status bar

indicates the file has been successfully generated, click the OK button. On the following screen, click Upload. A log will display the steps as a connection

is made to Firstech and the file is uploaded.

Upon completion, a four-digit reference number is given. This number indicates a successful upload and

is used to verify payments with Firstech should there be any problems.

Reports

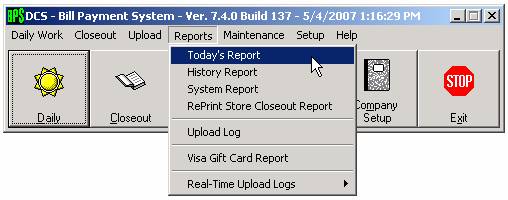

About Reports

A powerful set of reports

can be accessed from the BPS Reports

menu, as seen in the figure below. By

knowing the difference between these reports and how to set certain criteria,

you will be able to find the data you need quickly and easily.

What differentiates one

report from another is the data it contains and how that data is laid out. The table below provides an overview of their

similarities and differences.

|

BPS Reports Summary |

|

|

Today’s Report |

Transactions taken in this session, grouped by bill

type. |

|

History Report |

Transactions taken for a specified date range, grouped

by bill type |

|

System Report |

Extra controls for

choosing transaction type and date range, grouped by teller OR date/time. |

|

RePrint Closeout Report |

Detailed report that

displays every transaction for a selected session (including voids), grouped

by bill type. |

|

Upload Log |

List of items uploaded

for a selected service. Grouped by upload batch (sorted by

reference number). |

|

Real-Time Upload Logs |

Return messages of

real-time services (gift cards, instant payments, etc.). |

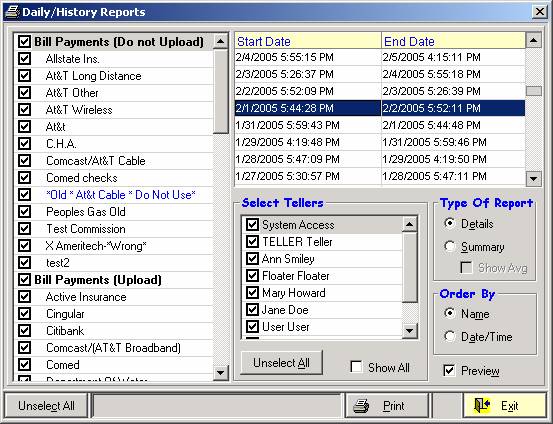

Selecting Data for Reports

Before a report is generated

and displayed, a selection screen allows you to choose what information will be

included on it. For example, the system

defaults to today’s date with all transactions selected— this may need to be

adjusted based on the information required.

Select Transactions

On the left side of the

screen is a list of all available transactions.

By default, all items are selected and will therefore be included in the

report. The Unselect All button at the bottom of the screen will

simultaneously uncheck all boxes (and change to Select All). Checking or unchecking a group header (indicated by bold) will affect

all items in the subgroup.

At the top right is the

date range box. The start and end dates

are used to identify a session (if you close out at night, the end date will

represent the business day). The

sessions are in chronological order, with the most recent day at the top of the

list. Scroll down to view past dates.

Select a date by

highlighting it with the mouse. Multiple

days can be selected by highlighting the first date, holding down the SHIFT key, and clicking the last date

in the range. Doing so should result in

multiple days being highlighted.

Select Tellers

Beneath the date range

box is a list of system users, all checked by default. This indicates that the report will include

all transactions, regardless of who keyed them in. To see the work of a specific teller, click

the Unselect All button (to

remove all check-marks) and then select the desired user.

Type of Report & Order By

On the right side of the

screen, choose Details to see

every individual transaction, or Summary

to view totals. When the detailed report

is selected, you have some further options as to how the items will be

sorted. Choose Name for alphabetical order, or Date/Time for chronological.

Preview

Preview, checked by default,

means that the report will be displayed on the screen. To send the report directly to the printer

without viewing it, uncheck the Preview

box.

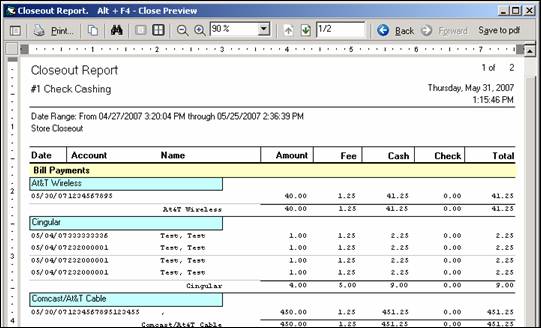

Viewing, Printing, and Saving Reports

All BPS reports use the same window (seen below) for

display.

The menu bar across the top of the screen has many functions that

allow the user to search, print, change layout, and save in different

formats. Each feature is described in the table below.

|

BPS Reports Summary |

|

|

|

If a table of contents exists for this report, it is displayed

by clicking here. This feature is generally not included in DCS

reports. |

|

|

Print the report. |

|

|

Copy the image of this report to the clipboard. |

|

|

Search for a word or number located in this document. |

|

|

Change the layout when multiple pages exist. |

|

|

Click on the magnifying glasses to zoom in and out. Or

use the drop down list to choose in terms of percentages. |

|

|

When multiple pages exist, the green arrows move to the next

or previous page. The “2/3” in this example indicates that the second

of three pages is currently being displayed. Highlight this area and

type a page number to move directly to that page. |

|

|

Similar to the green arrows, click on the Back

and Forward buttons to move to different sheets in a report. |

|

|

Save this report in a format compatible with Adobe

products. |

|

|

Save this report in a format compatible with Microsoft

Word. |

|

|

Close the report. |

Upgrading and Online Documentation

Quarterly Upgrades

DCS is constantly making improvements to our software as technology

changes, users make requests, and we come up with easier and more efficient

ways of operating. As new versions

of the software become available, they will automatically be downloaded to your

computer. This is done via a special

program running on one of your computers called DRL Client (typically installed

on the same computer as Cardserver).

While a specific release date will be announced in bulletins and

emails, the downloads are staggered over the course of

seven days. This is completely random

and is done for technical support reasons.

Special logic also prevents an upgrade from downloading within 2 days of

the 1st of the month. Stores

that use the BPS system are typically busy during this

period and do not have time to upgrade software.

During those times when a new version has been released but not

downloaded to your store (due to staggering or because it is close to the 1st),

a manual download is possible. From the

help menu, choose Install New Version

(if available).

Once a new version is available, the user is prompt to upgrade

after logging in to the program. A link

to upgrade instructions is available from that screen.

Online BPS Manual

Choosing this option provides a direct link to the documentation

you are currently reading. Your computer must have a working internet

connection to access this file.

Online Release Notes

From the help menu, click on What is New (on Web) for a link to the quarterly release notes. There you will find a list of improvements

and fixes that have been implemented since the previous release.